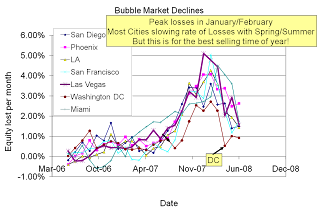

This is a long post and it took a bit of work to create. So rather than have it lost after so other posts, I'm bringing the charts back to the front. Please grab a drink as there are a ton of charts to wade through. But I ask you the reader to look at them as a group; they're related. We're in a new point of the market. You'll find sales and foreclosures for DQ news, afford ability from Wells Fargo, and inventory from ziprealty and the MRIS.

If you're not a bit scared after reviewing these graphs... I think you've missed something. We have proof of tight credit, foreclosures exceeding sales in more and more markets, and a general bear market that is entrenched in real estate. In California, foreclosures are happening faster than sales. In other words, the current sales spike that is foreclosure dominated isn't enough to slow the decline nor even the driving forces behind the decline! California and Florida on their own are going to end the mortgage market as we knew it. Too many Billions have been destroyed as is.

Do remember that during the 1990's SoCal downturn, the communities that were immune through 1992... were the ones hardest hit. The overall market only dropped 18%. But the "immune" areas had late price drops that went to almost 40%!!! That is the pattern we're currently following. This time Nationally. Edit from the first posting: I have no charts to 100% prove this. Believe or not. My main prediction is that 2009 will be the year of the greatest price drops in US real estate. We're not quite yet in the timeframe of the greatest price drops, but we will be soon.

Affordability is shooting up. But wait... this assumes income measurement are following the historical pattern! Please, do not get me wrong.

I appreciate Wells Fargo Keeping the same methodology. But one assumption about these charts is that grey market income is *not* declining. Can we assume that anymore? Certainly not in Southern California. I believe, as with many metrics, that the change in incomes is being under-recorded. I do not fault Wells Fargo, they are doing the best job possible. LA is also in trouble due to Hedge funds cutting the funding of "Hollywood." Also, do you see advertising spending going up or down in 2009? Advertising has been keeping the Westside market alive. If that revenue drops significantly, expect things to get worse quickly.

I've selected the same cities for a while. Notice the spike up in affordability. Its all due to a drop in sales price. Mostly due to foreclosure sales and

Here is a close up on the latest. Do review the previous graph of where affordability has been historically. Note: For some cities (e.g., DC), I expect the new plateau to be at a slightly lower level of affordability (due to the city establishing 'economy of scale' in the world market).

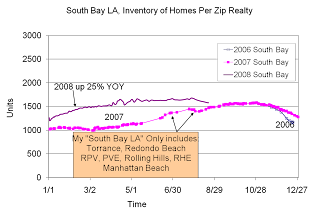

National inventory isn't growing like it used to. If it wasn't for all of the markets with huge amounts of 'shadow inventory,' I would think this downturn was closer to being done than it is. We'll hit a bottom; but not before 2011 and more likely in 2013 or so.

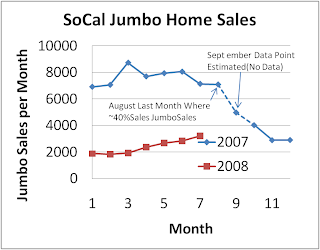

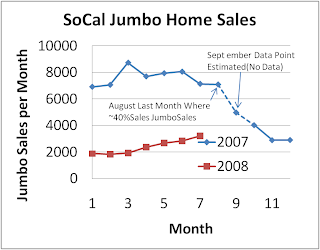

If there is one thing to scare you, it should be the drying up of the Jumbo mortgage market. Look at the hit SoCal is taking. Thankfully,

DQ News has published information on the distribution of mortgages.

I'm going to be posting this chart I from Deutsche Bank over at Patrick.net. It really shows how the real estate market is in a brave new world:

We're at the point where many markets are now driven by foreclosures. Since there is better data for Southern California than many other markets, I'm plotting my home region. But these charts plot a trend that would be true of Florida, Arizona, Nevada, Ohio, Michigan, Virginia, and a few other markets. Its brutal now for a home owner to try and sell. The competition from foreclosures will even impact the 'immune' markets. I'm seeing high end properties skip foreclosure (jingle mail) and go straight on the market as bank owned.

I'm plotting California sales and foreclosures by quarter to take out noise in the data. Compare this graph to the next one and

Note that foreclosures exceeded sales in California in the first and second quarter! California is getting ready to really implode.

Compare this graph to the above one:

Now on to other cities. Sales are down, but not too bad:

But note the Median price is down. I haven't been in DC for a year, but I'd bet bargain hunting is going on:

Las Vegas is in a later stage of implosion. I know of too many people holding on in Las Vegas who should be selling, so the small drop in published inventory is masking a rising shadow inventory. Once the recession really gets going, expect the next wave of the Tsunami to spank Las Vegas. US Air 'de-hubbed' in Las Vegas for a reason: The Origination and Destination market is dying.

Phoenix has been the poster child of the bubble for a while. IIRC, 40% of the jobs in Phoenix are for growing Phoenix. I'm an airline fan, so I wonder if US air will get into trouble in Phoenix too.

Overall, DC's inventory hasn't climbed much over 2007. But look at Case-Shiller prices, inventory is too high in the region to sustain current prices overall. Counter is that DC's median income has gone up ~6%.

Houston is an interesting case.

I posted before how it has the fastest job growth in the USA. But how much is due to the commodities bubble? Part of the reason I'm curious about Houston is that high end manufacturing and IT outsourcing is drifting to the city. Is it enough to insulate it during the later parts of this recession?

This is where I plan to buy. But there is a disconnect between official inventory and what I see on the street. Can we say shadow inventory? ;) Seriously, prices peaking at 11.2X income was insane! Ok, Wells Fargo put it at 9.3X income and now at 6.3X income. Per Wells Fargo, the last recession hit a trough at 3.5X income. My oh my... that leave a lot of downside. Note: Per Wells Fargo incomes have dropped ~3%. Personally, I think the income drop is accelerating.

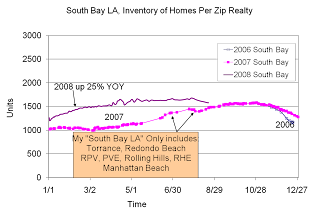

I've skipped a lot of comment, but note that LA's decline in inventory is mostly due to foreclosures taking homes temporarily off the market. Mostly in the ex-urbs.

This is quite a bit to review here. I ask my readers patience to note the pattern these graphs lay out. Its showing the impact of the credit crunch, income loss, and the recession we are in. I still make no definitive predictions until we get to "Fall, probably late Fall." But soon we will see data showing a major transition. Soon might be November data... Heck, late Fall technically is until 12/20, so it could be in the December data; but I suspect it won't happen at the end of Fall.

Other bloggers are noting the bottom will be a two to three year bog where prices stay low due to the economy and credit tightening. I see no reason to debate that.

Got Popcorn?

Neil