I switched to Google Analytics at the end of May. For some reason, it took a few days to get the site feed up and going. Maybe this is due to my lack of articles for a bit? ;)

Site Usage

2,379 Visits

3,179 Pageviews

1.34 Pages/Visit

82.18% Bounce Rate

00:02:15 Avg. Time on Site

45.61% % New Visits

My latest records show that I'm getting a constant ~700 visitors a week (this is down from late last year). Its is my goal to write enough articles to make the time worthwhile for my readership. Do note that in August my first child will be born, so if there is downtime... I'll just have to rebuild the viewership. ;)

To my daily visitors from Bangalore, Norway, and Sweden, thank you. I'm pleasantly surprised to have daily readers from that area. Almost half my readership is from the massive "Westside LA" routers in West Hollywood (includes Santa Monica inland). While I have a decent readership in the SouthBay part of LA, I was surprised more of my readers live north of the 10 freeway.

The article previous to this is my inventory graphs.

Got Popcorn?

Neil

Sunday, June 29, 2008

Inventory At records!

Ok, national inventory is 200 below the highest peak I've measured, but since so much shadow inventory is being kept hidden off the market, its obvious we're at an all time inventory peak! Some cities show declines, but the number of for sales signs not in the MLS makes me wonder are we only seeing a false decline in their local inventory?

Seriously, its one thing to manipulate the spin, its a totally different sin to manipulate the numbers. This is really frustrating home sellers (as their homes are not making it onto Realtor.com and other national selling sites quickly).

Ok, rant off, now some charts.

In a word, wow! Yes, the slope of growth is slowing... But if anyone expects that BS spring recovery, you can see its not going to happen. 2009 is going to be the steepest year of price drops (nationally).

This is just fishy. If you drive around, the 'for sale' signs dominate. Yes, some is the drop in inventory in the ex-urbs... but in the nice core, 1/4 of the inventory seems to be shadow inventory! And the ex-urb inventory only dropped to be processed from a foreclosure into a REO.

South Bay LA: ALL TIME PEAK INVENTORY!

Inventory is up a bit... but look what happens if you break out a few cities. You can really see the plague of flipping that went on in Torrance and Redondo beach. Do not think the nearby cities will be immune; the REIC really put a cancer into this area:

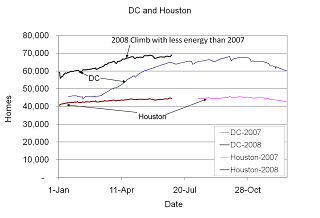

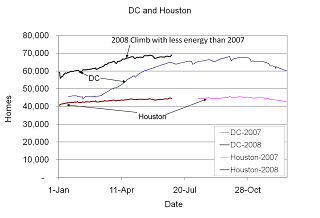

What about other areas? DC and Houston March along. I think the only reason Houston isn't falling apart is that the state of Texas has been extremely pro-active in recruiting companies out of the bubble markets to their cities. The low workers comp is alone a nice incentive. Add to that the moving reimbursements, lower taxes, and lower cost of living... and you can understand why Aerospace is leaving some of its older bases and moving to Colorado and Houston:

DC is at a record inventory. Now what would it be like if the shadow inventory were properly added in? I have no feel on the size of the shadow inventory there. But if there is one thing I've learned, the louder an area screems 'its different here' the more likely it is to have Shadow inventory.

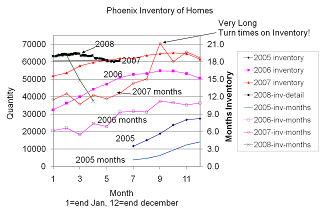

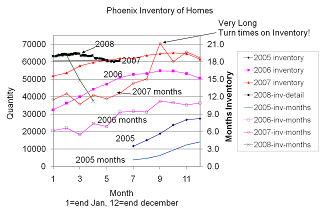

Is the mother of all bubbles in Phoenix or Las Vegas? Both are burning down their months of inventory... both have declines in their inventory. But how much is real and how much is the time lag for conversion to REO (or shadow inventory)? I know too many people trying to sell Las Vegas property to even begin to believe they're within 18 months of the bottom. Phoenix, in a way, is in worse shape. They have far too much of their employment based upon expanding Phoenix (its been described as plumbers building for electricians...).

Notice something? Las Vegas and Phoenix are now showing much improved inventory turn times yet they still have FAR more inventory than is healthy. They're both above the 8.7 month inventory 'trip line' that triggers fast declines in sales values until inventory can be brought under 5 months. But as I've noted, there is Shadow inventory out there. In Phoenix is mostly homes being processed to REO's. In Las Vegas, its that massive condo building boom.. and the REO's. I'm going to be *very* curious to see the August numbers for both. Heck, I'm going to be very curious to see the August numbers for everywhere!

There are many things I can accept in life as just salesmanship. But the growing fraud in the inventory numbers is that: fraud. If you sell a stock as a sure thing there are regulations. When are the regulations on real estate transactions going to be enforced? (Its not as if there are not laws out there.)

After an investment mania there must be ambivalence. We have a long way to go. If you wish, read my real estate emotions article to see the long path we have yet to travel. The inventory suggests we have a long way to go. The fact that the REIC feels they need to hide the current true status of the inventory... implies its worse than this bear was stating.

If you're going out to buy, understand you must bargain like an a-hole. If not, you are the sucker. If you're a seller, realize that high value mortgages are becoming tougher and tougher to acrue. I'm also starting to see those who have owned for a *long* time realizing that its sell now or own for the rest of their lifetime. Its funny watching the local realtor trying to convince families that have owned since 1975 not to sell... for once they set the comps... those will be the comps. But on streets were few (if any) homes have sold in decades, we're starting to see inventory. I know of two homes being prepped for sale where I would *love* to buy. In both cases, the owners are treating the sales like a stock or auto sale; you price to sell and nothing else matters. Yes, you shine it up to sell... But you also price it to sell.

I've mentioned before I know dozens of people who will never have to sell any of their real estate. But I've also mentioned that they would sell *at any price* at some point to become liquid. I didn't expect them to wake up this early; they've been smart investors their whole lives, so I should have given them more credit. Besides, some realize their businesses will have to go into hibernation for 2+ years. At this point, they're retiring.

Why the long winded conclusion? *Everything* is aligning for 2009 to have the steepest drops in prices. The only counter examples are the manufacturing moves to the Carolinas, Texas, Alabama, and other low cost of living states. But manufacturing jobs do not create a real estate frenzy. But they are the start of the recovery. (Yes, far before the bottom... but some reasons I do not see a Depression.)

June and August vie to be the peak selling months of the year... normally So I'll be very curious to publish an article after August. ;)

I still think the wheels come off in the Fall and in Spring of 2009 I see a convergence of numbers that scars even this bear. e.g.j: Alt-A forced resets start in mass, taxes are due, employment, airline/auto/municipal employment declines, savings depletion, integrated impact on consumer spending due to high oil prices, dollar decline, slowing velocity of money, credit crisis, Hedge fund failures, and baby boomers waking up to the fact they haven't saved enough as a group to retire. Oh, I should also mention that the price range of homes I want to buy in are influenced by stock market performance too. By the spring, all of those who will buy to get out of the stock market will have bought.

Got Popcorn?

Neil

Seriously, its one thing to manipulate the spin, its a totally different sin to manipulate the numbers. This is really frustrating home sellers (as their homes are not making it onto Realtor.com and other national selling sites quickly).

Ok, rant off, now some charts.

In a word, wow! Yes, the slope of growth is slowing... But if anyone expects that BS spring recovery, you can see its not going to happen. 2009 is going to be the steepest year of price drops (nationally).

This is just fishy. If you drive around, the 'for sale' signs dominate. Yes, some is the drop in inventory in the ex-urbs... but in the nice core, 1/4 of the inventory seems to be shadow inventory! And the ex-urb inventory only dropped to be processed from a foreclosure into a REO.

South Bay LA: ALL TIME PEAK INVENTORY!

Inventory is up a bit... but look what happens if you break out a few cities. You can really see the plague of flipping that went on in Torrance and Redondo beach. Do not think the nearby cities will be immune; the REIC really put a cancer into this area:

What about other areas? DC and Houston March along. I think the only reason Houston isn't falling apart is that the state of Texas has been extremely pro-active in recruiting companies out of the bubble markets to their cities. The low workers comp is alone a nice incentive. Add to that the moving reimbursements, lower taxes, and lower cost of living... and you can understand why Aerospace is leaving some of its older bases and moving to Colorado and Houston:

DC is at a record inventory. Now what would it be like if the shadow inventory were properly added in? I have no feel on the size of the shadow inventory there. But if there is one thing I've learned, the louder an area screems 'its different here' the more likely it is to have Shadow inventory.

Is the mother of all bubbles in Phoenix or Las Vegas? Both are burning down their months of inventory... both have declines in their inventory. But how much is real and how much is the time lag for conversion to REO (or shadow inventory)? I know too many people trying to sell Las Vegas property to even begin to believe they're within 18 months of the bottom. Phoenix, in a way, is in worse shape. They have far too much of their employment based upon expanding Phoenix (its been described as plumbers building for electricians...).

Notice something? Las Vegas and Phoenix are now showing much improved inventory turn times yet they still have FAR more inventory than is healthy. They're both above the 8.7 month inventory 'trip line' that triggers fast declines in sales values until inventory can be brought under 5 months. But as I've noted, there is Shadow inventory out there. In Phoenix is mostly homes being processed to REO's. In Las Vegas, its that massive condo building boom.. and the REO's. I'm going to be *very* curious to see the August numbers for both. Heck, I'm going to be very curious to see the August numbers for everywhere!

There are many things I can accept in life as just salesmanship. But the growing fraud in the inventory numbers is that: fraud. If you sell a stock as a sure thing there are regulations. When are the regulations on real estate transactions going to be enforced? (Its not as if there are not laws out there.)

After an investment mania there must be ambivalence. We have a long way to go. If you wish, read my real estate emotions article to see the long path we have yet to travel. The inventory suggests we have a long way to go. The fact that the REIC feels they need to hide the current true status of the inventory... implies its worse than this bear was stating.

If you're going out to buy, understand you must bargain like an a-hole. If not, you are the sucker. If you're a seller, realize that high value mortgages are becoming tougher and tougher to acrue. I'm also starting to see those who have owned for a *long* time realizing that its sell now or own for the rest of their lifetime. Its funny watching the local realtor trying to convince families that have owned since 1975 not to sell... for once they set the comps... those will be the comps. But on streets were few (if any) homes have sold in decades, we're starting to see inventory. I know of two homes being prepped for sale where I would *love* to buy. In both cases, the owners are treating the sales like a stock or auto sale; you price to sell and nothing else matters. Yes, you shine it up to sell... But you also price it to sell.

I've mentioned before I know dozens of people who will never have to sell any of their real estate. But I've also mentioned that they would sell *at any price* at some point to become liquid. I didn't expect them to wake up this early; they've been smart investors their whole lives, so I should have given them more credit. Besides, some realize their businesses will have to go into hibernation for 2+ years. At this point, they're retiring.

Why the long winded conclusion? *Everything* is aligning for 2009 to have the steepest drops in prices. The only counter examples are the manufacturing moves to the Carolinas, Texas, Alabama, and other low cost of living states. But manufacturing jobs do not create a real estate frenzy. But they are the start of the recovery. (Yes, far before the bottom... but some reasons I do not see a Depression.)

June and August vie to be the peak selling months of the year... normally So I'll be very curious to publish an article after August. ;)

I still think the wheels come off in the Fall and in Spring of 2009 I see a convergence of numbers that scars even this bear. e.g.j: Alt-A forced resets start in mass, taxes are due, employment, airline/auto/municipal employment declines, savings depletion, integrated impact on consumer spending due to high oil prices, dollar decline, slowing velocity of money, credit crisis, Hedge fund failures, and baby boomers waking up to the fact they haven't saved enough as a group to retire. Oh, I should also mention that the price range of homes I want to buy in are influenced by stock market performance too. By the spring, all of those who will buy to get out of the stock market will have bought.

Got Popcorn?

Neil

Saturday, June 28, 2008

Shadow Inventory

Now this is taking it to a new level.

San Diego listings not making MLS

Ok, we joked about one way the bubble 'would be contained' would be to hide listings. Now this is apparently a technical error, but its held all new listings off the national MLS for 30 days in San Diego!

I like to use ziprealy to find out the status of neighborhoods, but far too many listings are missing. Its amusing how broken the market is. But in this case, San Diego sellers are frustrated as they are missing out selling during those critical first few weeks. Most homes sell within a few weeks or languish. In this market, that is just unfair to the sellers.

We need an open MLS.

Got Popcorn?

Neil

San Diego listings not making MLS

Ok, we joked about one way the bubble 'would be contained' would be to hide listings. Now this is apparently a technical error, but its held all new listings off the national MLS for 30 days in San Diego!

I like to use ziprealy to find out the status of neighborhoods, but far too many listings are missing. Its amusing how broken the market is. But in this case, San Diego sellers are frustrated as they are missing out selling during those critical first few weeks. Most homes sell within a few weeks or languish. In this market, that is just unfair to the sellers.

We need an open MLS.

Got Popcorn?

Neil

Thursday, June 26, 2008

June Real Estate Emotions

With the focus on oil prices, its almost not worth writing what I consider my signature article. The talk is all about "middle class price out" in between discussions on new $15,000 motorcycles that get 50 or 60 mpg. (Sweet rides! If I wasn't about to become a father... oh, I think a few 'fish stories' on mpg are creeping up around various social circles.)

If you read last month's article, don't even both reading except for the concluding paragraph. Despite oil, stock prices, economic pain... The investment emotions haven't progressed at all. This is the weakest summer selling season in over a decade. Most comparisons are too the 'peace dividend recession.' And yet... there is a false hope out there.

We're continuing on in the major emotional transition state of Desperation. The amount of anger in the system seems to be oscillating with no perceptible national change this month. I expect anger to peak either this summer or next summer; the Ponzi victims remain upset that the news about the emperor being naked is getting out Why? active emotions peak in hot weather

I just love this quote. Its so appropriate to the housing bubble:

Ponzi's supporters were outraged at the officers who arrested him. 17,000 people had invested millions, maybe tens of millions, with Ponzi. Many who were ruined were so blinded by their faith in the man or their refusal to admit their foolishness that they still regarded him as a hero.

http://en.wikipedia.org/wiki/Ponzi

To the Kübler-Ross grief cycle and what fraction of the population seems to be in each emotion.

Stability: 40% (Old homeowners and bubble bloggers)

Immobilization: 17% (Prices dropping? Can't be.)

Denial: 8% (No! Real estate only goes up!)

Anger: 15% (This one must be discussed)

Bargaining: 5% (Ok, we can cut the price and lead the market)

Depression: 5% (We're going to lose our home. Just let them take it...)

Testing: 5%

Acceptance: 5% (Stop payming, we're toast. Move back in with mom.)

No change.

Comment: None. No change. We're in idle. My data has big holes in it every year this time of year... it seems to be a time that buyers are ambivalent about real estate (in general, not everyone obviously). Or maybe its just me enjoying the weather change. :)

Onto the investment emotions. We're deep in desperation, with Florida trending into Panic as the front runner. This is the same graph I updated in January; emotions are progressing on that timeline. Option-Arms are hitting their limits and helping drive the correction and emotion changes. For most of this year we'll stick in desperation. Anyone who thinks this will turn quickly is trying to sell you something.

1. Optimism

2. Excitement

3. Thrill

4. Euphoria (market price peak) Peaked in late 2005/early 2006

5. Anxiety (I'm a long term investor, not a speculator. Lasted ~10 months)

6. Denial (Reached in October of 2006 until mid-May of 2007, ~8 months)

7. Fear (Reached in mid-May of 2007 to mid/late February 2008, ~9 months).

8. ****Desperation: Current state ***** since mid/late February 2008

9. Panic: Fall 2008 looks to be the start. Probably late fall

10 Capitulation: Spring 2009 through the winter of 2009. Yes, basically 2009!

11 Despondency (start of market price bottom) Not before winter 2009. Possibly as late as 2010. Much more uncertainty here.

12 Depression (end of market price bottom) Not over before summer 2011, probably later. It could be as late as 2014. Don't let anyone BS you into buying soon.

13 Hope (hey, this investment has picked up off its bottom)

14 Relief (Its almost what I paid for it...) about 2017

15 Optimism (cycle starts again)

Sellers bet the farm (house) on appreciating real estate and those days are gone. This year will only begin to shake out the more feeble 'homeowners.' 2009 is when I predict the greatest price drops (both nominal and real prices). The bottom is a long way off... We'll be into 2010 before we have enough information to guess when the bottom *might* occur.

The option-ARM resets will be the motivator in 2008/2009. Not the planned resets, but the loans hitting their limits (due to negative amortization) or when J6P realizes their overpriced McMansion isn't the road to riches they imagined and putting 50%+ of income into a failed investment is just throwing good money after bad. Recall, over 90% of Option-ARM borrowers only pay the minimum; that negative amortization is going to drive the market in 2008 and 2009 as more and more home-debtors flee the pain.

The time to start looking is when your local news goes from covering the foreclosure bargains to why its smart to rent. Until that happens, the wanna be Trumps will be liquidating their failed mini-empires. This will drive investment emotions. Emotions, income, and inventory will drive transaction rates and prices.

Yea... an almost copy and paste of last month's article which was a copy of the month's before. Really, nothing much changed. I expect no change until the Fall. Ok, I HOPE for no change until the fall. Otherwise I'll have to change my prediction from "R" to "D" if it happens much ealier.

Got popcorn?

Neil

If you read last month's article, don't even both reading except for the concluding paragraph. Despite oil, stock prices, economic pain... The investment emotions haven't progressed at all. This is the weakest summer selling season in over a decade. Most comparisons are too the 'peace dividend recession.' And yet... there is a false hope out there.

We're continuing on in the major emotional transition state of Desperation. The amount of anger in the system seems to be oscillating with no perceptible national change this month. I expect anger to peak either this summer or next summer; the Ponzi victims remain upset that the news about the emperor being naked is getting out Why? active emotions peak in hot weather

I just love this quote. Its so appropriate to the housing bubble:

Ponzi's supporters were outraged at the officers who arrested him. 17,000 people had invested millions, maybe tens of millions, with Ponzi. Many who were ruined were so blinded by their faith in the man or their refusal to admit their foolishness that they still regarded him as a hero.

http://en.wikipedia.org/wiki/Ponzi

To the Kübler-Ross grief cycle and what fraction of the population seems to be in each emotion.

Stability: 40% (Old homeowners and bubble bloggers)

Immobilization: 17% (Prices dropping? Can't be.)

Denial: 8% (No! Real estate only goes up!)

Anger: 15% (This one must be discussed)

Bargaining: 5% (Ok, we can cut the price and lead the market)

Depression: 5% (We're going to lose our home. Just let them take it...)

Testing: 5%

Acceptance: 5% (Stop payming, we're toast. Move back in with mom.)

No change.

Comment: None. No change. We're in idle. My data has big holes in it every year this time of year... it seems to be a time that buyers are ambivalent about real estate (in general, not everyone obviously). Or maybe its just me enjoying the weather change. :)

Onto the investment emotions. We're deep in desperation, with Florida trending into Panic as the front runner. This is the same graph I updated in January; emotions are progressing on that timeline. Option-Arms are hitting their limits and helping drive the correction and emotion changes. For most of this year we'll stick in desperation. Anyone who thinks this will turn quickly is trying to sell you something.

1. Optimism

2. Excitement

3. Thrill

4. Euphoria (market price peak) Peaked in late 2005/early 2006

5. Anxiety (I'm a long term investor, not a speculator. Lasted ~10 months)

6. Denial (Reached in October of 2006 until mid-May of 2007, ~8 months)

7. Fear (Reached in mid-May of 2007 to mid/late February 2008, ~9 months).

8. ****Desperation: Current state ***** since mid/late February 2008

9. Panic: Fall 2008 looks to be the start. Probably late fall

10 Capitulation: Spring 2009 through the winter of 2009. Yes, basically 2009!

11 Despondency (start of market price bottom) Not before winter 2009. Possibly as late as 2010. Much more uncertainty here.

12 Depression (end of market price bottom) Not over before summer 2011, probably later. It could be as late as 2014. Don't let anyone BS you into buying soon.

13 Hope (hey, this investment has picked up off its bottom)

14 Relief (Its almost what I paid for it...) about 2017

15 Optimism (cycle starts again)

Sellers bet the farm (house) on appreciating real estate and those days are gone. This year will only begin to shake out the more feeble 'homeowners.' 2009 is when I predict the greatest price drops (both nominal and real prices). The bottom is a long way off... We'll be into 2010 before we have enough information to guess when the bottom *might* occur.

The option-ARM resets will be the motivator in 2008/2009. Not the planned resets, but the loans hitting their limits (due to negative amortization) or when J6P realizes their overpriced McMansion isn't the road to riches they imagined and putting 50%+ of income into a failed investment is just throwing good money after bad. Recall, over 90% of Option-ARM borrowers only pay the minimum; that negative amortization is going to drive the market in 2008 and 2009 as more and more home-debtors flee the pain.

The time to start looking is when your local news goes from covering the foreclosure bargains to why its smart to rent. Until that happens, the wanna be Trumps will be liquidating their failed mini-empires. This will drive investment emotions. Emotions, income, and inventory will drive transaction rates and prices.

Yea... an almost copy and paste of last month's article which was a copy of the month's before. Really, nothing much changed. I expect no change until the Fall. Ok, I HOPE for no change until the fall. Otherwise I'll have to change my prediction from "R" to "D" if it happens much ealier.

Got popcorn?

Neil

Tuesday, June 24, 2008

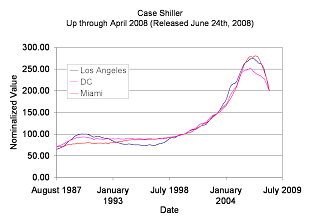

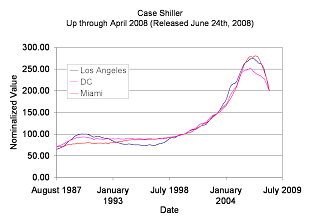

Case Shiller April Results just out

The MSM started the morning with articles stating how the rate of decline was improving. Then I noticed they changed their headlines.

http://biz.yahoo.com/rb/080624/usa_housing_caseshiller.html

Do you see a recovery here? Do you see, along with record seasonal inventory, sales below decade lows, and tightening credit a reason to go out and buy? The next 15 months should see the most rapid price declines. I still do not see an emotional change until the Fall (again, probably late Fall). But I'm paying more attention. I still see a convergence of factors that will transition us another emotional state in April 2009.

Capitualation is the emotion with the greatest price drops. I predict that will happen in 2009 not 2008. For home sellers, I believe you have until the end of July to get out. Sell now or be priced in forever (or until you walk away).

Oh... there will always be sales. I do not predict the Realtor commisions to drop below .25% of GNP (a normal recession bottom). Last I saw on CalculatedRisk, we're down in the 0.5% of GNP range (a pretty accelerated rate of real estate sales by normal measures). That's right, what we see now is the results of STILL ACCELERATED REAL ESTATE SALES. When we go to recession levels of sales...

Of course the NAR is still predicting a recover in the 2nd half of 2008. That's a joke. Leading indicators from San Diego (thanks to Jim the Realtor, there are good Realtors out there) show that the credit tightening above $800k is accelerating. No one should be buying above $600k without 25%+ down. Soon we'll be back so sane lending practices. Somehow we're still at loose lending standards. (How? Oh yea... the Fed is pumping money which is killing the value of the dollar.)

Its all a question of when the Fed switches to a strong dollar policy. If you have a large down payment saved up, you should be looking forward to that event (for it will lower the montly costs of home ownership).

Got Popcorn?

Neil

http://biz.yahoo.com/rb/080624/usa_housing_caseshiller.html

Do you see a recovery here? Do you see, along with record seasonal inventory, sales below decade lows, and tightening credit a reason to go out and buy? The next 15 months should see the most rapid price declines. I still do not see an emotional change until the Fall (again, probably late Fall). But I'm paying more attention. I still see a convergence of factors that will transition us another emotional state in April 2009.

Capitualation is the emotion with the greatest price drops. I predict that will happen in 2009 not 2008. For home sellers, I believe you have until the end of July to get out. Sell now or be priced in forever (or until you walk away).

Oh... there will always be sales. I do not predict the Realtor commisions to drop below .25% of GNP (a normal recession bottom). Last I saw on CalculatedRisk, we're down in the 0.5% of GNP range (a pretty accelerated rate of real estate sales by normal measures). That's right, what we see now is the results of STILL ACCELERATED REAL ESTATE SALES. When we go to recession levels of sales...

Of course the NAR is still predicting a recover in the 2nd half of 2008. That's a joke. Leading indicators from San Diego (thanks to Jim the Realtor, there are good Realtors out there) show that the credit tightening above $800k is accelerating. No one should be buying above $600k without 25%+ down. Soon we'll be back so sane lending practices. Somehow we're still at loose lending standards. (How? Oh yea... the Fed is pumping money which is killing the value of the dollar.)

Its all a question of when the Fed switches to a strong dollar policy. If you have a large down payment saved up, you should be looking forward to that event (for it will lower the montly costs of home ownership).

Got Popcorn?

Neil

Saturday, June 21, 2008

Defunct Airlines

Sadly, this is a horrid market for the airline business. Worldwide 35 have failed so far during the first six months of 2008.

Compare that 35 to the YEAR totals

2007: 30

2006: 25

2005: 40

2004: 41

2003: 58

2002: 37

2001: 42

2000: 19

From:

http://www.justplanes.com/AirlineHist.html

What to note from this history:

We were just coming out of the post 2001 airline failure time frame.

Edit: Classier Image to one more appropriate for this blog.

I'm expecting it to only get worse. Yield is down, passenger count is down, and fuel costs are up, up and up. So far I've seen announcements for US capacity to be cut about 8%. That will translate to 8% fewer jobs, 8% (or more) less advertising (once the current pre-bought air time expires), and about 10% less fuel burn (they are preferentially cutting kerosene hogs).

The trickle down through the economy hasn't even begun. I'll leave the reports on retail to the other blogs that are doing a better job. I'm an aviation nut as well as a bubble blogger. So I'll keep reporting on the economic indications from airlines.

The poster child of the airline downturn is Las Vegas right now. Its falling apart. Only Hawaii is seeing similar levels of service cuts. Why? These are vacation markets. Vacations are optional in a downturn. We're seeing the same impact almost everywhere that relies on vacation traffic (e.g., DC) Somehow, Florida is still doing ok (in terms on number of travelers. I do not have the stats on spending.)

An aviation thread on Las vegas:

Got Popcorn?

Neil

Compare that 35 to the YEAR totals

2007: 30

2006: 25

2005: 40

2004: 41

2003: 58

2002: 37

2001: 42

2000: 19

From:

http://www.justplanes.com/AirlineHist.html

What to note from this history:

We were just coming out of the post 2001 airline failure time frame.

Edit: Classier Image to one more appropriate for this blog.

I'm expecting it to only get worse. Yield is down, passenger count is down, and fuel costs are up, up and up. So far I've seen announcements for US capacity to be cut about 8%. That will translate to 8% fewer jobs, 8% (or more) less advertising (once the current pre-bought air time expires), and about 10% less fuel burn (they are preferentially cutting kerosene hogs).

The trickle down through the economy hasn't even begun. I'll leave the reports on retail to the other blogs that are doing a better job. I'm an aviation nut as well as a bubble blogger. So I'll keep reporting on the economic indications from airlines.

The poster child of the airline downturn is Las Vegas right now. Its falling apart. Only Hawaii is seeing similar levels of service cuts. Why? These are vacation markets. Vacations are optional in a downturn. We're seeing the same impact almost everywhere that relies on vacation traffic (e.g., DC) Somehow, Florida is still doing ok (in terms on number of travelers. I do not have the stats on spending.)

An aviation thread on Las vegas:

Got Popcorn?

Neil

Friday, June 20, 2008

Auto Sales

China is on track to sell 10 million cars to its population this year. Anyone doubting that we're in recession should look at this:

China is trying to keep their oil subsidies in the ~$26Billion/year range. That means that as their consumption increases, they will approach world prices. The recent price hike is but the first step (they still are about $1/gallon under world prices).

Also, do not forget that India's consumption is increasing too.

From:

www.marketoracle.co.uk/Article345.html

Now India auto sales are a fraction of the US and China. They're about 100k per month (not quite). But with Tata passing Hyundai to become the #2 auto seller in India... with the upcoming Nano they could break away and push India into the big leagues. That is, assuming India Highway construction can catch up to China's construction.

Why does this matter? Oil is impacting the economy. A huge fraction of jobs are tied to cars. Are car sales down due to the economy or gasoline sales? I believe both. Fewer car commuters is a good thing long term if they can be accommodated by efficient and effective mass transit. Short term that's an issue. Unwanted rapid changes in the economy are a destabilizing influence.

Can I hope that LA can reclaim some of the huge amount of land dedicated to cars and re-allocate it to better uses? (Start with rail and later put in some trees!)

Got Popcorn?

Neil

China is trying to keep their oil subsidies in the ~$26Billion/year range. That means that as their consumption increases, they will approach world prices. The recent price hike is but the first step (they still are about $1/gallon under world prices).

Also, do not forget that India's consumption is increasing too.

From:

www.marketoracle.co.uk/Article345.html

Now India auto sales are a fraction of the US and China. They're about 100k per month (not quite). But with Tata passing Hyundai to become the #2 auto seller in India... with the upcoming Nano they could break away and push India into the big leagues. That is, assuming India Highway construction can catch up to China's construction.

Why does this matter? Oil is impacting the economy. A huge fraction of jobs are tied to cars. Are car sales down due to the economy or gasoline sales? I believe both. Fewer car commuters is a good thing long term if they can be accommodated by efficient and effective mass transit. Short term that's an issue. Unwanted rapid changes in the economy are a destabilizing influence.

Can I hope that LA can reclaim some of the huge amount of land dedicated to cars and re-allocate it to better uses? (Start with rail and later put in some trees!)

Got Popcorn?

Neil

Bank Downgrades

Calculated Risk has a link on how BofA is being downgraded due to the risks inherent in the Countrywide loan portfolio. So which banks do you think will be downgraded or fail within the next 12 months? How about even within 2008?

Wachovia, Indymac, Downey and a dozen others are obvious targets.

I'd like to hear what are the weak links internationally. Heck, update me on the East coast wink links too!

Got Popcorn?

Neil

Friday, June 13, 2008

Some good history links and suggestions

I'm a fan of reading and understanding what's happened before. Now, I truly believe Mark Twain's quote of "History doesn't repeat itself, but it does rhyme."

I'm a fan of books. If you really want to get to understand the great depression, take the time to read The Hungry Years

Its a depressing book, but well worth the time.

Bearmaster's history of the LA market is a MUST READ Its funny to be re-reading the same headlines as were spewed out before.

But it wouldn't be complete without reading up on Florida 1925. That one had a long downturn too. This summary is the best concise one I've found. I start at Chapter 11, the beginning of the fall. By this article, it really feels like we're in 1926 all over again. One of the reasons I'm obsessed that this Fall is the start of a rapid slide down.

This is but a snapshot. If you are not also keeping up on Calculated risk, I must suggest that too. The two web based articles are sufficient. Before you read the hungry years, you should first read Adam Smith's Wealth of Nations. Its best to have an understanding of what is about to happen.

Much of why I emphasize this is that my reading has re-aligned my predictions towards a more reasonable time scale. This is why the current false market makes me yawn. History has shown we can have these summers and then watch out for the Fall/Winter.

Got Popcorn?

Neil

I'm a fan of books. If you really want to get to understand the great depression, take the time to read The Hungry Years

Its a depressing book, but well worth the time.

Bearmaster's history of the LA market is a MUST READ Its funny to be re-reading the same headlines as were spewed out before.

But it wouldn't be complete without reading up on Florida 1925. That one had a long downturn too. This summary is the best concise one I've found. I start at Chapter 11, the beginning of the fall. By this article, it really feels like we're in 1926 all over again. One of the reasons I'm obsessed that this Fall is the start of a rapid slide down.

This is but a snapshot. If you are not also keeping up on Calculated risk, I must suggest that too. The two web based articles are sufficient. Before you read the hungry years, you should first read Adam Smith's Wealth of Nations. Its best to have an understanding of what is about to happen.

Much of why I emphasize this is that my reading has re-aligned my predictions towards a more reasonable time scale. This is why the current false market makes me yawn. History has shown we can have these summers and then watch out for the Fall/Winter.

Got Popcorn?

Neil

Tuesday, June 10, 2008

Alternate view on state of real estate emotions

I really like the Irvine housing blog.

Irvinerenter has a different opinion on where we are on real estate emotions.

I think we'll see Panic in Fall, late fall. Irvine renter thinks we're in a year of denial and that we won't see panic this year but rather fear this fall and winter.

The Irvine housing blog post

Either perception says wait. There won't be a quick recovery. With higher down payment requirements, righter credit (no longer just 'fogging a mirror'), and the recession... We won't see peak prices again for a long time. I'm now thinking, even with inflation, that my 2017 estimate is too optimistic. When do you think we'll see peak prices again?

Got Popcorn?

Neil

Irvinerenter has a different opinion on where we are on real estate emotions.

I think we'll see Panic in Fall, late fall. Irvine renter thinks we're in a year of denial and that we won't see panic this year but rather fear this fall and winter.

The Irvine housing blog post

Either perception says wait. There won't be a quick recovery. With higher down payment requirements, righter credit (no longer just 'fogging a mirror'), and the recession... We won't see peak prices again for a long time. I'm now thinking, even with inflation, that my 2017 estimate is too optimistic. When do you think we'll see peak prices again?

Got Popcorn?

Neil

Housing crisis hits the high end

Prices down, foreclosures up

In Palm Beach, Fla. (zip code 33480), median home prices fell 38% during that period, according to the real estate Web site Trulia. Prices in Greenwich, Conn. (06831), dropped 15%, while homes in Wayzata, Minn. (55391), are selling for 28% less.

Prices in other wealthy towns also declined: Gladwyne, Penn. (19035), was down 6%, and Beverly Hills (90210), Lincoln, Mass. (01773), and Ladue, Mo. (63124), each slid 2%.

"What I'm finding is that million dollar plus homes declined 4% or so [over the past 12 months]," said Don Kelly, a spokesman for Zaio, which is building a national data base of home value appraisals.

From this CNN article

Yea... the median is down a little. But we all know every buyer is getting the best home for the money. So its the similar home with the better view or finer fittings that is selling. The undiscounted albatross is sitting. One can now find homes that have been on the market two years in most high end neighborhoods.

As to people being able to wait out this slump... never before has the "upper middle class" put so much of their wealth into real estate. Never before are they so far in debt. Look at the blue book values on used cars. Down a bit eh? In particular SUV's and large BMW's or Mercedes. Oh yea, these immune neighborhoods have tons of occupants piling on the credit card debt. When that means of maintaining lifestyle goes away, so will the home prices.

Nothing will happen quick. But anyone who buys in the next 24 months is being stupid. There is no bottom within that time frame. Where I want to buy will probably bottom in 2011 or 2012. Some areas might bottom earlier, but none will before 2010. Why? Debt, incomes, gasoline, and credit. Its called a deep recession folks. All the small business owners seem to get it right now. Soon it will be the whole population.

Got Popcorn?

Neil

ps

The photo is of a McMansion in Beijing China. This is going to be one interesting global recession.

Monday, June 09, 2008

Small businesses fight to survive in tough economy

Its tough out there economically.

What struck me:

In the meantime, wages haven't grown and the job market is tepid, at best. On Friday, the Labor Department said the nation's unemployment rate jumped to 5.5 percent in May - the biggest monthly rise since 1986 - as wary employers cut 49,000 jobs. Average hourly earnings for jobholders rose to $17.94 in May, up 0.3 percent from the previous month.

From: This Forbes article with too many ads

We're definitely in a recession. :(

Got Popcorn?

Neil

What struck me:

In the meantime, wages haven't grown and the job market is tepid, at best. On Friday, the Labor Department said the nation's unemployment rate jumped to 5.5 percent in May - the biggest monthly rise since 1986 - as wary employers cut 49,000 jobs. Average hourly earnings for jobholders rose to $17.94 in May, up 0.3 percent from the previous month.

From: This Forbes article with too many ads

We're definitely in a recession. :(

Got Popcorn?

Neil

Saturday, June 07, 2008

Local Restaurants struggling

My wife and I have been married almost 13 months. So we've decided to host a dinner celebrating our 1st Anniversary with immediate family and the tinniest number of friends. We think this will cost an even thousand dollars to pull off.

The restaurants are desperate for our business in the 90274 and 90275 zip codes. What? This is only a grand! We decided to go with a local restaurant, family owned, in the 90275 that my parents have been going to for almost its whole 31 year history.

The owner of that restaurant almost sighed with relief when we made the deposit. He mentioned a few times how "the economy" was impact all the restaurants. At first I wasn't listening too much (it was about our dinner, I wasn't in 'blogging mode.') But then I started to notice something.

1. He listed off a series of corporate customers that once upon a time two to three times a month clients for the same room we're going to rent out. Most I had never heard of (mostly small import/export companies). But one was local Realtor (shock, not!) and the big client was Toyota. (huh? I guess the pickup business is creating corporate wide cost cutting.)

2. He mentioned a few friends of my family that have cut back too. This is sad. Nothing more really needs to be said.

For those that think the core areas won't be hit hard, this suggests strongly otherwise. People might not have to sell, but the surplus of available rentals means no one has to buy either.

There is also a huge disconnect in the 90274, 90275, 90277, and 90278 between the number of homes listed and the number of Realtor signs planted on the front lawns. I cannot prove anything, but I think we've reached the stage where the shadow inventory is of the same order of magnitude as the 'official MLS inventory.'

My wife and I have decided to stop going to chain restaurants and focus 100% on the family owned ones we love. We've even decided to focus on the small number we'd really miss if they disappeared. Since we only eat out once a week, we're not going to change their future. But I ask my fellow readers to think about where they spend their money; which businesses to you want to be around through and after this downturn? We've decided that the local restaurants with local personality are far more important than a chain that could be replaced with another chain restaurant. I did not expect 90275/90275/90277 to be hurting like this yet. Not to where all of the restaurant owners are hurting.

Got Popcorn?

Neil

The restaurants are desperate for our business in the 90274 and 90275 zip codes. What? This is only a grand! We decided to go with a local restaurant, family owned, in the 90275 that my parents have been going to for almost its whole 31 year history.

The owner of that restaurant almost sighed with relief when we made the deposit. He mentioned a few times how "the economy" was impact all the restaurants. At first I wasn't listening too much (it was about our dinner, I wasn't in 'blogging mode.') But then I started to notice something.

1. He listed off a series of corporate customers that once upon a time two to three times a month clients for the same room we're going to rent out. Most I had never heard of (mostly small import/export companies). But one was local Realtor (shock, not!) and the big client was Toyota. (huh? I guess the pickup business is creating corporate wide cost cutting.)

2. He mentioned a few friends of my family that have cut back too. This is sad. Nothing more really needs to be said.

For those that think the core areas won't be hit hard, this suggests strongly otherwise. People might not have to sell, but the surplus of available rentals means no one has to buy either.

There is also a huge disconnect in the 90274, 90275, 90277, and 90278 between the number of homes listed and the number of Realtor signs planted on the front lawns. I cannot prove anything, but I think we've reached the stage where the shadow inventory is of the same order of magnitude as the 'official MLS inventory.'

My wife and I have decided to stop going to chain restaurants and focus 100% on the family owned ones we love. We've even decided to focus on the small number we'd really miss if they disappeared. Since we only eat out once a week, we're not going to change their future. But I ask my fellow readers to think about where they spend their money; which businesses to you want to be around through and after this downturn? We've decided that the local restaurants with local personality are far more important than a chain that could be replaced with another chain restaurant. I did not expect 90275/90275/90277 to be hurting like this yet. Not to where all of the restaurant owners are hurting.

Got Popcorn?

Neil

Friday, June 06, 2008

WSJ: Real Estate Woes of Banks Mount

"As long as the housing market is on a downward path, as long as those prices continue to fall, I think there's a risk that the losses could continue to mount on a variety of loans," Federal Reserve Vice Chairman Donald Kohn told the Senate Banking Committee Thursday.

Ok, that is a given. The chart on projected bank failures is amazing. I keep repeating that the indicators are that the steepest drop in home prices will be in 2009. This chart shows the steepest losses in construction loans being in 2009. That implies that 2010 could be even worse than 2009. Yikes!

edit: WSJ source article I shouldn't forget my source links. ;)

The time to pretend everything is ok is over. The LA Times this morning has an interesting article on how jobs that see peak demand at the onset of a recession... are becoming very difficult to get (e.g., lifeguards).

Side note:

I thought by now I'd have enough additional information to blog a new article on job transfers. Instead, the big companies are being clever. They're moving 500 jobs here... 500 there. Never a big enough move to make headlines. Certainly not enough of a headline to compete with GM, Ford, and Chrysler cutting truck production.

Too many of the "upper middle class" are poseurs without savings. Never before have we been in a situation where so many of our high wage earners need to borrow to maintain appearances.

Oh wait, people tried to warn about this since 2005!

http://www.freerepublic.com/focus/f-news/1514966/posts

I love this quote:

"Americans are basically living a lifestyle that they can afford as long as the unexpected doesn't happen," said Robert Manning, a consumer finance expert at the Rochester Institute of Technology.

Why? It makes me laugh. Recessions are to be expected. This one is just beginning. Most people are about to learn why we never let total DTI exceed 35% (That is 35% of gross income to service monthly debt payments. I really dislike thinking in monthly payments... but since most Americans think that way, I'll accommodate the majority and write in monthly cash flow terms.)

I just drove the LA freeways this morning to do some errands. I honestly expected to lose 20 to 30 minutes in traffic. When I arrived at my destination early, I pulled us www.sigalert.com. I was shocked to see only one of the freeways (55 down in Orange Country) was red (to signify bad stop and go traffic). While many people I know are trying to carpool, what is this doing to the economy? At a minimum, this implies further slowing car sales (fewer miles=less need to replace the car or a longer life of the vehicle if its sold used). I think this will trickle down to auto shops, tire vendors, and the whole 1/6th of the US population employed in selling, maintaining, building, or otherwise tied to the auto industries.

Since there are more than two major industries still on the decline, we can expect the recession to get worse. I'm a huge fan of such simple "rules of thumb." They help cut through the BS we hear too much of. But it also keeps me from becoming too bearish for un-needed reasons. Unless I can identify 3+ industries in decline... I know the economy is going to grow. Today we know construction (plus related, such as lumber), airlines (but not aircraft manufacturing (yet)), automobiles, and finance are all declining industries. Yes, there are bright spots (tech), but not enough to offset four major industries in decline. Not to mention too many states have yet to rationalize their budgets. Traditionally, the MSM peaks their discussion of recessions when the government jobs are cut back (either hours, positions, or pay).

Overall, we have a long way to go. If anything, the downside emotional states will linger. I think we're in an uptick of a big "down 5" as the Elliot wave theorists like to say.

Edit: NYTimes "heat map" of delinquent loans.

California hasn't even begun to enter the stage. So many of the "Prime Adjustable" haven't adjusted... and while the prime fixed has a low default rate, it is creeping up. Notice the map is for 90+ days past due. Once California implodes, good luck getting a jumbo mortgage.

Got Popcorn?

Neil

Ok, that is a given. The chart on projected bank failures is amazing. I keep repeating that the indicators are that the steepest drop in home prices will be in 2009. This chart shows the steepest losses in construction loans being in 2009. That implies that 2010 could be even worse than 2009. Yikes!

edit: WSJ source article I shouldn't forget my source links. ;)

The time to pretend everything is ok is over. The LA Times this morning has an interesting article on how jobs that see peak demand at the onset of a recession... are becoming very difficult to get (e.g., lifeguards).

Side note:

I thought by now I'd have enough additional information to blog a new article on job transfers. Instead, the big companies are being clever. They're moving 500 jobs here... 500 there. Never a big enough move to make headlines. Certainly not enough of a headline to compete with GM, Ford, and Chrysler cutting truck production.

Too many of the "upper middle class" are poseurs without savings. Never before have we been in a situation where so many of our high wage earners need to borrow to maintain appearances.

Oh wait, people tried to warn about this since 2005!

http://www.freerepublic.com/focus/f-news/1514966/posts

I love this quote:

"Americans are basically living a lifestyle that they can afford as long as the unexpected doesn't happen," said Robert Manning, a consumer finance expert at the Rochester Institute of Technology.

Why? It makes me laugh. Recessions are to be expected. This one is just beginning. Most people are about to learn why we never let total DTI exceed 35% (That is 35% of gross income to service monthly debt payments. I really dislike thinking in monthly payments... but since most Americans think that way, I'll accommodate the majority and write in monthly cash flow terms.)

I just drove the LA freeways this morning to do some errands. I honestly expected to lose 20 to 30 minutes in traffic. When I arrived at my destination early, I pulled us www.sigalert.com. I was shocked to see only one of the freeways (55 down in Orange Country) was red (to signify bad stop and go traffic). While many people I know are trying to carpool, what is this doing to the economy? At a minimum, this implies further slowing car sales (fewer miles=less need to replace the car or a longer life of the vehicle if its sold used). I think this will trickle down to auto shops, tire vendors, and the whole 1/6th of the US population employed in selling, maintaining, building, or otherwise tied to the auto industries.

Since there are more than two major industries still on the decline, we can expect the recession to get worse. I'm a huge fan of such simple "rules of thumb." They help cut through the BS we hear too much of. But it also keeps me from becoming too bearish for un-needed reasons. Unless I can identify 3+ industries in decline... I know the economy is going to grow. Today we know construction (plus related, such as lumber), airlines (but not aircraft manufacturing (yet)), automobiles, and finance are all declining industries. Yes, there are bright spots (tech), but not enough to offset four major industries in decline. Not to mention too many states have yet to rationalize their budgets. Traditionally, the MSM peaks their discussion of recessions when the government jobs are cut back (either hours, positions, or pay).

Overall, we have a long way to go. If anything, the downside emotional states will linger. I think we're in an uptick of a big "down 5" as the Elliot wave theorists like to say.

Edit: NYTimes "heat map" of delinquent loans.

California hasn't even begun to enter the stage. So many of the "Prime Adjustable" haven't adjusted... and while the prime fixed has a low default rate, it is creeping up. Notice the map is for 90+ days past due. Once California implodes, good luck getting a jumbo mortgage.

Got Popcorn?

Neil

Monday, June 02, 2008

I doubt we'll keep seeing home prices decline like now.

I've rounded down the current rates of declines and projected future Case-Shiller values. Its scary. We have markets going 25% below my inflation prediction as early as May of 2009. At the current rate, the last of the markets I'm tracking will drop 25% below the inflation (projected as 4% inflation) before the end of 2010!

We've never had a real estate correction proceed at this rate. Ok, Florida 1925/1926 was faster, but that was regional. This is national. This is serious and scary.

By the way, projections we're near the bottom just amuse me. We're about to exit the best season of the year for selling a home. The rest of 2008 should be a better buyer's market. It will not be that obvious in June. Like I've said before, expect the big change in the Fall. Once the kids are back in school, sellers will be faced with very interesting choices.

I think everything that can be done to get suckers deserving families into homes will be done. But everything is pointing to greater down payment requirements. Are you saving for that rainy day?

I'm not sure when the bottom will be. It won't be before 2010 is certain. Its also certain that the recovery this time is going to be slow. Mostly due to lenders having to re-learn old lessons.

Got Popcorn?

Neil

We've never had a real estate correction proceed at this rate. Ok, Florida 1925/1926 was faster, but that was regional. This is national. This is serious and scary.

By the way, projections we're near the bottom just amuse me. We're about to exit the best season of the year for selling a home. The rest of 2008 should be a better buyer's market. It will not be that obvious in June. Like I've said before, expect the big change in the Fall. Once the kids are back in school, sellers will be faced with very interesting choices.

I think everything that can be done to get

I'm not sure when the bottom will be. It won't be before 2010 is certain. Its also certain that the recovery this time is going to be slow. Mostly due to lenders having to re-learn old lessons.

Got Popcorn?

Neil

Sunday, June 01, 2008

Tardy May Real estate emotions

Ok,sleep out prioritized this update. Here is the quick summary: No change.

Not to mention work is crazy! We're keeping to our "deliver technical miracles schedule!"

We're continuing on in the major emotional transition state of Desperation. The amount of anger in the system seems to be oscillating with no perceptible national change this month. I expect anger to peak either this summer or next summer; the Ponzi victims remain upset that the news about the emperor being naked is getting out Why? active emotions peak in hot weather

I just love this quote. Its so appropriate to the housing bubble:

Ponzi's supporters were outraged at the officers who arrested him. 17,000 people had invested millions, maybe tens of millions, with Ponzi. Many who were ruined were so blinded by their faith in the man or their refusal to admit their foolishness that they still regarded him as a hero.

http://en.wikipedia.org/wiki/Ponzi

To the Kübler-Ross grief cycle and what fraction of the population seems to be in each emotion.

Stability: 40% (Old homeowners and bubble bloggers)

Immobilization: 17% (Prices dropping? Can't be.)

Denial: 8% (No! Real estate only goes up!)

Anger: 15% (This one must be discussed)

Bargaining: 5% (Ok, we can cut the price and lead the market)

Depression: 5% (We're going to lose our home. Just let them take it...)

Testing: 5%

Acceptance: 5% (Stop payming, we're toast. Move back in with mom.)

No change.

Comment: None. No change. We're in idle. My data has big holes in it every year this time of year... it seems to be a time that buyers are ambivalent about real estate (in general, not everyone obviously). Or maybe its just me enjoying the weather change. :)

Onto the investment emotions. We're deep in desperation, with Florida trending into Panic as the front runner. This is the same graph I updated in January; emotions are progressing on that timeline. Option-Arms are hitting their limits and helping drive the correction and emotion changes. For most of this year we'll stick in desperation. Anyone who thinks this will turn quickly is trying to sell you something.

1. Optimism

2. Excitement

3. Thrill

4. Euphoria (market price peak) Peaked in late 2005/early 2006

5. Anxiety (I'm a long term investor, not a speculator. Lasted ~10 months)

6. Denial (Reached in October of 2006 until mid-May of 2007, ~8 months)

7. Fear (Reached in mid-May of 2007 to mid/late February 2008, ~9 months).

8. ****Desperation: Current state ***** since mid/late February 2008

9. Panic: Fall 2008 looks to be the start. Probably late fall

10 Capitulation: Spring 2009 through the winter of 2009. Yes, basically 2009!

11 Despondency (start of market price bottom) Not before winter 2009. Possibly as late as 2010. Much more uncertainty here.

12 Depression (end of market price bottom) Not over before summer 2011, probably later. It could be as late as 2014. Don't let anyone BS you into buying soon.

13 Hope (hey, this investment has picked up off its bottom)

14 Relief (Its almost what I paid for it...) about 2017

15 Optimism (cycle starts again)

Sellers bet the farm (house) on appreciating real estate and those days are gone. This year will only begin to shake out the more feeble 'homeowners.' 2009 is when I predict the greatest price drops (both nominal and real prices). The bottom is a long way off... We'll be into 2010 before we have enough information to guess when the bottom *might* occur.

The option-ARM resets will be the motivator in 2008/2009. Not the planned resets, but the loans hitting their limits (due to negative amortization) or when J6P realizes their overpriced McMansion isn't the road to riches they imagined and putting 50%+ of income into a failed investment is just throwing good money after bad. Recall, over 90% of Option-ARM borrowers only pay the minimum; that negative amortization is going to drive the market in 2008 and 2009 as more and more home-debtors flee the pain.

The time to start looking is when your local news goes from covering the foreclosure bargains to why its smart to rent. Until that happens, the wanna be Trumps will be liquidating their failed mini-empires. This will drive investment emotions. Emotions, income, and inventory will drive transaction rates and prices.

Yea... an almost copy and paste of last month's article. Really, nothing much changed.

Got popcorn?

Neil

Not to mention work is crazy! We're keeping to our "deliver technical miracles schedule!"

We're continuing on in the major emotional transition state of Desperation. The amount of anger in the system seems to be oscillating with no perceptible national change this month. I expect anger to peak either this summer or next summer; the Ponzi victims remain upset that the news about the emperor being naked is getting out Why? active emotions peak in hot weather

I just love this quote. Its so appropriate to the housing bubble:

Ponzi's supporters were outraged at the officers who arrested him. 17,000 people had invested millions, maybe tens of millions, with Ponzi. Many who were ruined were so blinded by their faith in the man or their refusal to admit their foolishness that they still regarded him as a hero.

http://en.wikipedia.org/wiki/Ponzi

To the Kübler-Ross grief cycle and what fraction of the population seems to be in each emotion.

Stability: 40% (Old homeowners and bubble bloggers)

Immobilization: 17% (Prices dropping? Can't be.)

Denial: 8% (No! Real estate only goes up!)

Anger: 15% (This one must be discussed)

Bargaining: 5% (Ok, we can cut the price and lead the market)

Depression: 5% (We're going to lose our home. Just let them take it...)

Testing: 5%

Acceptance: 5% (Stop payming, we're toast. Move back in with mom.)

No change.

Comment: None. No change. We're in idle. My data has big holes in it every year this time of year... it seems to be a time that buyers are ambivalent about real estate (in general, not everyone obviously). Or maybe its just me enjoying the weather change. :)

Onto the investment emotions. We're deep in desperation, with Florida trending into Panic as the front runner. This is the same graph I updated in January; emotions are progressing on that timeline. Option-Arms are hitting their limits and helping drive the correction and emotion changes. For most of this year we'll stick in desperation. Anyone who thinks this will turn quickly is trying to sell you something.

1. Optimism

2. Excitement

3. Thrill

4. Euphoria (market price peak) Peaked in late 2005/early 2006

5. Anxiety (I'm a long term investor, not a speculator. Lasted ~10 months)

6. Denial (Reached in October of 2006 until mid-May of 2007, ~8 months)

7. Fear (Reached in mid-May of 2007 to mid/late February 2008, ~9 months).

8. ****Desperation: Current state ***** since mid/late February 2008

9. Panic: Fall 2008 looks to be the start. Probably late fall

10 Capitulation: Spring 2009 through the winter of 2009. Yes, basically 2009!

11 Despondency (start of market price bottom) Not before winter 2009. Possibly as late as 2010. Much more uncertainty here.

12 Depression (end of market price bottom) Not over before summer 2011, probably later. It could be as late as 2014. Don't let anyone BS you into buying soon.

13 Hope (hey, this investment has picked up off its bottom)

14 Relief (Its almost what I paid for it...) about 2017

15 Optimism (cycle starts again)

Sellers bet the farm (house) on appreciating real estate and those days are gone. This year will only begin to shake out the more feeble 'homeowners.' 2009 is when I predict the greatest price drops (both nominal and real prices). The bottom is a long way off... We'll be into 2010 before we have enough information to guess when the bottom *might* occur.

The option-ARM resets will be the motivator in 2008/2009. Not the planned resets, but the loans hitting their limits (due to negative amortization) or when J6P realizes their overpriced McMansion isn't the road to riches they imagined and putting 50%+ of income into a failed investment is just throwing good money after bad. Recall, over 90% of Option-ARM borrowers only pay the minimum; that negative amortization is going to drive the market in 2008 and 2009 as more and more home-debtors flee the pain.

The time to start looking is when your local news goes from covering the foreclosure bargains to why its smart to rent. Until that happens, the wanna be Trumps will be liquidating their failed mini-empires. This will drive investment emotions. Emotions, income, and inventory will drive transaction rates and prices.

Yea... an almost copy and paste of last month's article. Really, nothing much changed.

Got popcorn?

Neil

Subscribe to:

Posts (Atom)