For the blogger party/dinner this Sunday e-mail wannabuy3@gmail.com or see the previous thread. :)

You've probably heard about the low sales of new homes. The WSJ provides a little more information:

About 68,000 homes were sold last month, down from 74,000 in July, the government said. At the end of August, 531,000 homes were on the market -- and only about a third of them were finished. That means builders could be stuck with large inventories as the market weakens further.

"This is staggering," said Joseph Brusuelas, chief U.S. economist at IDEAglobal, a research firm that advises investors. Further big price declines, he said, are "going to be debilitating."

Only about 6,000 new homes priced at $500,000 or more were sold in August, down from 9,000 in each of the previous three months and 11,000 in August 2006.

WSJ Article

What struck me was the strong drop in home sales above $500k. I would like to know how sales at higher brackets are doing. Does anyone have such information? Its interesting enough to see August, a strong sales month, weaker than July. I'm curious to see September sales. This credit crunch is definitely taking on a life of its own.

I still haven't heard a single proposal on how the commercial paper market will be saved. That's about $400B worth of paper that is looking for a home within 60 days. Oh... I have no doubt they'll be able to partially dodge the bullet... but not fully. Those pier loans are weighing down the I-banks a wee bit, so the normal relief channels are constrained.

Got popcorn?

Neil

Friday, September 28, 2007

Tuesday, September 25, 2007

Blogger party: ITs happening!

Want to meet up for some bearish fun?

Please RVSP in this thread or e-mail wannabuy3@gmail.com

Address:

Cheesecake Factory

605 N Harbor Dr

Redondo Beach, CA 90277

When: 6pm on 9/30/2007 (Sunday).

Count: 34+

Neil +2

Bearmaster +1

John ? (please verify)

M.B.A (+2)

Cereal (from HBB)

SpeedingPullet +1

Mike (maybe)

Lorna (+ Mike)

elvismcduf

larenter +1

GaudiaRay

LA_FiatWoman

Houseless +1

Captain Crunch +1

Sunrise +1

oc-ed + 1

OcInvestor + 1

Redondo Beach dude +1

H

Nightowlsix +1?

Please let me know if there are any changes. For two days all of gotten is span on the e-mail. ;)

But this will be so much fun!!!

We've had a few dropouts, but not many. :) Please let me know if anything's changed. Want to show up early? I'll be there. It apparently is required to show up early to get a table for a big group.

Got popcorn?

Neil

Please RVSP in this thread or e-mail wannabuy3@gmail.com

Address:

Cheesecake Factory

605 N Harbor Dr

Redondo Beach, CA 90277

When: 6pm on 9/30/2007 (Sunday).

Count: 34+

Neil +2

Bearmaster +1

John ? (please verify)

M.B.A (+2)

Cereal (from HBB)

SpeedingPullet +1

Mike (maybe)

Lorna (+ Mike)

elvismcduf

larenter +1

GaudiaRay

LA_FiatWoman

Houseless +1

Captain Crunch +1

Sunrise +1

oc-ed + 1

OcInvestor + 1

Redondo Beach dude +1

H

Nightowlsix +1?

Please let me know if there are any changes. For two days all of gotten is span on the e-mail. ;)

But this will be so much fun!!!

We've had a few dropouts, but not many. :) Please let me know if anything's changed. Want to show up early? I'll be there. It apparently is required to show up early to get a table for a big group.

Got popcorn?

Neil

Monday, September 24, 2007

GM on strike

"This is horrible, but we're die-hard union, so we have to," Ahrens said. "We got a mortgage, two car payments and tons of freaking bills."

That is the quote that struck me. You have 73,000 people striking because GM cannot afford the health costs for 339,000 retirees. Ouch. 73,000 trying to pay for 400,000. No wonder GM and Ford are losing market share. :(

But look what the stock market did as soon as the strike was announced. The cause or coincident? I don't know.

GM on strike

Its going to be interesting when the house sales and Case-Shiller come out tomorrow for August. Since only two weeks of August were part of the credit-crunch, I'm expecting a 3% to 15% decline in sales over July. August should have stronger sales than July... From what I'm hearing September is down, but not enough to calibrate.

We're in a cycle of moderate price drops. I expect the peak rate of drops to match the peak rate of price increases: 2.5% to 4.0% per month. The question is when do we get to that accelerated rate (we're at 0.5% to 1.5% per month now) and for how long?

Got popcorn?

Neil

That is the quote that struck me. You have 73,000 people striking because GM cannot afford the health costs for 339,000 retirees. Ouch. 73,000 trying to pay for 400,000. No wonder GM and Ford are losing market share. :(

But look what the stock market did as soon as the strike was announced. The cause or coincident? I don't know.

GM on strike

Its going to be interesting when the house sales and Case-Shiller come out tomorrow for August. Since only two weeks of August were part of the credit-crunch, I'm expecting a 3% to 15% decline in sales over July. August should have stronger sales than July... From what I'm hearing September is down, but not enough to calibrate.

We're in a cycle of moderate price drops. I expect the peak rate of drops to match the peak rate of price increases: 2.5% to 4.0% per month. The question is when do we get to that accelerated rate (we're at 0.5% to 1.5% per month now) and for how long?

Got popcorn?

Neil

Sunday, September 23, 2007

WSJ on weakening dollar

Please go to two posts earlier for the blogger dinner/party RSVP's for September 30th.

Its a very real world example that makes sense, but I never expect the WSJ to use strippers as an example of how a weakening dollar can effect a US 'industry.'

http://tinyurl.com/create.php

or a more direct link:

Canada Is Giddy

The owner of five strip clubs in Detroit and Windsor, Ontario, says American dancers are heading to Canada to earn the strengthened Canadian currency, and Canadian customers are heading to Detroit because their dollars go further there.

Later in the article:

Economists fear that Canadian exporters will face an uphill battle since their goods just became more expensive. For Canadians living in the U.S. who are paid in U.S. dollars, it's also not such great news.

and still later:

Mr. Katzman, the Windsor strip-club owner, is philosophical. He says that, last year, 90% of his dancers were Canadians. About 200 of them drove down from Toronto and Montreal to take advantage of the U.S. dollars American men typically paid with.

This year, he has more American women dancing in his Canadian clubs -- about 160 -- than he has Canadians.

Umm... yea... this could be impacting immigration trends. ;)

So let's see... weaker dollar means higher cost services in the US, 'workers' leave the US and probably smaller imports. And people who export to us are going to have a much tougher time. And my wife wonders why I agreed so readily to buy her imported Christmas gift... today.

Not if we can get the Yuan to float. Cest la vie. Either way, I'm predicting a drop in the imbalance of payments in 2008.

Got popcorn?

Neil

Its a very real world example that makes sense, but I never expect the WSJ to use strippers as an example of how a weakening dollar can effect a US 'industry.'

http://tinyurl.com/create.php

or a more direct link:

Canada Is Giddy

The owner of five strip clubs in Detroit and Windsor, Ontario, says American dancers are heading to Canada to earn the strengthened Canadian currency, and Canadian customers are heading to Detroit because their dollars go further there.

Later in the article:

Economists fear that Canadian exporters will face an uphill battle since their goods just became more expensive. For Canadians living in the U.S. who are paid in U.S. dollars, it's also not such great news.

and still later:

Mr. Katzman, the Windsor strip-club owner, is philosophical. He says that, last year, 90% of his dancers were Canadians. About 200 of them drove down from Toronto and Montreal to take advantage of the U.S. dollars American men typically paid with.

This year, he has more American women dancing in his Canadian clubs -- about 160 -- than he has Canadians.

Umm... yea... this could be impacting immigration trends. ;)

So let's see... weaker dollar means higher cost services in the US, 'workers' leave the US and probably smaller imports. And people who export to us are going to have a much tougher time. And my wife wonders why I agreed so readily to buy her imported Christmas gift... today.

Not if we can get the Yuan to float. Cest la vie. Either way, I'm predicting a drop in the imbalance of payments in 2008.

Got popcorn?

Neil

Friday, September 21, 2007

Real Estate Emotions September Update

For the blogger party/dinner on September 30th (6pm), please RSVP on the previous thread.

I'm going to add to my real estate emotions column. I'm also going to start tracking where we are in the The Kübler-Ross grief cycle. I'm not going to say which Kübler-Ross emotion we're in, but rather the fraction of the population in each emotion. Most of the discussion skips three of the emotions, but they are important. Don't worry, I'm also keeping with my "investment related emotions," but as its going on a timeline that's been there for months. The only change is I've moved a chance of desperation starting earlier than what I predicted a month ago. I'm less confident of my further out emotions now. But I'll discuss that later.

To the Kübler-Ross grief cycle and what fraction of the population seems to be in each emotion.

Stability: 50% (Old homeowners and bubble bloggers)

Immobilization: 30% (Prices dropping? Can't be.)

Denial: 5% (No! Real estate only goes up!)

Anger: 5% (This one must be discussed)

Bargaining: 2.5% (Ok, we can cut the price and lead the market)

Depression: 2.5% (We're going to lose our home. Just let them take it...)

Testing: 3%

Acceptance: 2% (Walk away, we're toast)

The dangerous ones are the ones in the "Anger stage." Notice on many blogs the counter is brutal? They are practically screaming real estate "facts" that have never been true. For example, I loved a comment "No market has ever dropped 40%." Oh... how about 90275 in the 1990's downturn? Hmmm... ?

Notice most people are in stability. If you bought a home pre-2003 and didn't HELOC, there isn't much reason to worry outside of flipper havens. Expect this group to shrink; but note that a majority of the people in stable group will remain stable. e.g., my folks live in a neighborhood of homes bought in the early 1970's. Unless medical problems crop up, they'll be living in a neighborhood of homes mostly bought in the early 1970's a decade from now.

The "Immobilization" group is interesting. Expect them to play quite a role during the spring selling season as they go from passive to active emotions. They'll be forced to transition through their emotions fast. But fast means an emotion a month; don't expect anything more. This is a slow process.

This feeds the overall investment emotions:

1. Optimism

2. Excitement

3. Thrill

4. Euphoria (market price peak) Peaked in late 2005/early 2006

5. Anxiety (I'm a long term investor, not a speculator.)

6. Denial (Reached in October of 2006 until mid-May of 2007)

****7. Fear (Reached in mid-May of 2007). *****Current state****

8. Desperation Predicted to start in October/November 2007

9. Panic: Early mid 2008 looks to be the start. Exactly when? Depends on the credit markets.

10 Capitulation Could it be summer 2008 2009?

11 Despondency (start of market price bottom)

12 Depression (end of market price bottom) Not over before summer 2011, probably later.

13 Hope (hey, this investment has picked up off its bottom)

14 Relief (Its almost what I paid for it...)

15 Optimism (cycle starts again)

Basically I've lost confidence in my predictions post 2009. :( Why? As I look back over my bubble blogging history, I notice a trend that I'm always expecting things to happen faster than they do. But that doesn't change the overall conclusions:

1. Do not buy today. Heck, unless you can bargain well, do not buy in 2008 or 2009. When to start buying? Let's discuss Fall 2009. ;)

2. Preserve your cash. I'm not an investment expert, so pick your own strategy (goldbug, foreign currency/stocks, "sin stocks", etc.)

3. Sales will continue to slow (buyers doubt/calculation, tighter credit)

4. Prices are getting primed for a sharp drop world wide. Yes, world wide. There are no markets left where "its different here."

5. Whatever you do, don't listen to a salesperson on what to do.

6. Remember, real estate occurs in the margins. It doesn't take even 20% of the people panicking to tank a market. So don't worry about my low predictions. Its going to take 18 months to move a large fraction of the population over.

Got popcorn?

Neil

I'm going to add to my real estate emotions column. I'm also going to start tracking where we are in the The Kübler-Ross grief cycle. I'm not going to say which Kübler-Ross emotion we're in, but rather the fraction of the population in each emotion. Most of the discussion skips three of the emotions, but they are important. Don't worry, I'm also keeping with my "investment related emotions," but as its going on a timeline that's been there for months. The only change is I've moved a chance of desperation starting earlier than what I predicted a month ago. I'm less confident of my further out emotions now. But I'll discuss that later.

To the Kübler-Ross grief cycle and what fraction of the population seems to be in each emotion.

Stability: 50% (Old homeowners and bubble bloggers)

Immobilization: 30% (Prices dropping? Can't be.)

Denial: 5% (No! Real estate only goes up!)

Anger: 5% (This one must be discussed)

Bargaining: 2.5% (Ok, we can cut the price and lead the market)

Depression: 2.5% (We're going to lose our home. Just let them take it...)

Testing: 3%

Acceptance: 2% (Walk away, we're toast)

The dangerous ones are the ones in the "Anger stage." Notice on many blogs the counter is brutal? They are practically screaming real estate "facts" that have never been true. For example, I loved a comment "No market has ever dropped 40%." Oh... how about 90275 in the 1990's downturn? Hmmm... ?

Notice most people are in stability. If you bought a home pre-2003 and didn't HELOC, there isn't much reason to worry outside of flipper havens. Expect this group to shrink; but note that a majority of the people in stable group will remain stable. e.g., my folks live in a neighborhood of homes bought in the early 1970's. Unless medical problems crop up, they'll be living in a neighborhood of homes mostly bought in the early 1970's a decade from now.

The "Immobilization" group is interesting. Expect them to play quite a role during the spring selling season as they go from passive to active emotions. They'll be forced to transition through their emotions fast. But fast means an emotion a month; don't expect anything more. This is a slow process.

This feeds the overall investment emotions:

1. Optimism

2. Excitement

3. Thrill

4. Euphoria (market price peak) Peaked in late 2005/early 2006

5. Anxiety (I'm a long term investor, not a speculator.)

6. Denial (Reached in October of 2006 until mid-May of 2007)

****7. Fear (Reached in mid-May of 2007). *****Current state****

8. Desperation Predicted to start in October/November 2007

9. Panic: Early mid 2008 looks to be the start. Exactly when? Depends on the credit markets.

10 Capitulation Could it be summer 2008 2009?

11 Despondency (start of market price bottom)

12 Depression (end of market price bottom) Not over before summer 2011, probably later.

13 Hope (hey, this investment has picked up off its bottom)

14 Relief (Its almost what I paid for it...)

15 Optimism (cycle starts again)

Basically I've lost confidence in my predictions post 2009. :( Why? As I look back over my bubble blogging history, I notice a trend that I'm always expecting things to happen faster than they do. But that doesn't change the overall conclusions:

1. Do not buy today. Heck, unless you can bargain well, do not buy in 2008 or 2009. When to start buying? Let's discuss Fall 2009. ;)

2. Preserve your cash. I'm not an investment expert, so pick your own strategy (goldbug, foreign currency/stocks, "sin stocks", etc.)

3. Sales will continue to slow (buyers doubt/calculation, tighter credit)

4. Prices are getting primed for a sharp drop world wide. Yes, world wide. There are no markets left where "its different here."

5. Whatever you do, don't listen to a salesperson on what to do.

6. Remember, real estate occurs in the margins. It doesn't take even 20% of the people panicking to tank a market. So don't worry about my low predictions. Its going to take 18 months to move a large fraction of the population over.

Got popcorn?

Neil

Thursday, September 20, 2007

Blogger social season

We're still at 34+ for Sunday September 30th, 6pm at the Redondo beach cheesecake factory. (I double counted as other RSVP's came in. Oops.)

Please RVSP in this thread or e-mail wannabuy3@gmail.com

Address:

Cheesecake Factory

605 N Harbor Dr

Redondo Beach, CA 90277

Who's going (I'll update this)

Time: 9/20/2007 9:30am

Count: 34+

Neil +1

Bearmaster +1

John ? (please verify)

M.B.A (+2)

Cereal (from HBB)

SpeedingPullet +1

Mike (maybe)

Lorna (+ Mike)

elvismcduf

larenter +2

GaudiaRay

LA_FiatWoman

Houseless +1

Captain Crunch +1

Sunrise +1

oc-ed + 1

OcInvestor + 1

Redondo Beach dude +1

H

Nightowlsix +1?

I also received this e-mail on another blogger gathering:

Not to be outdone by Neil or by Big V,

az_lender and NYCityBoy kicked off the HBB social season today, September 19, with a lunch at Gente near Grand Central Station. Others present were NYCB's wife and a couple of his banking colleagues. A certain amount of the conversation naturally revolved around yesterday's Fed rate cut and our various foreign-currency investments. Another hot topic was (of course) all the HBBer's we've never met -- which means, ALL of them except az_lender and NYCityBoy. The only negative things we had to say were about the extremists who are buying mainly guns and ammo. Popcorn was not on the menu at Gente, but we send our regards to Neil and hope that his party is as much fun as ours. I have to admit I poked fun at NYCityBoy's Minnesota accent. Even though I knew he was from MN, I had automatically supposed he would talk like a New Yorker. (I'm from Phila and don't sound much like Maine or AZ.)

Got popcorn?

Neil

Please RVSP in this thread or e-mail wannabuy3@gmail.com

Address:

Cheesecake Factory

605 N Harbor Dr

Redondo Beach, CA 90277

Who's going (I'll update this)

Time: 9/20/2007 9:30am

Count: 34+

Neil +1

Bearmaster +1

John ? (please verify)

M.B.A (+2)

Cereal (from HBB)

SpeedingPullet +1

Mike (maybe)

Lorna (+ Mike)

elvismcduf

larenter +2

GaudiaRay

LA_FiatWoman

Houseless +1

Captain Crunch +1

Sunrise +1

oc-ed + 1

OcInvestor + 1

Redondo Beach dude +1

H

Nightowlsix +1?

I also received this e-mail on another blogger gathering:

Not to be outdone by Neil or by Big V,

az_lender and NYCityBoy kicked off the HBB social season today, September 19, with a lunch at Gente near Grand Central Station. Others present were NYCB's wife and a couple of his banking colleagues. A certain amount of the conversation naturally revolved around yesterday's Fed rate cut and our various foreign-currency investments. Another hot topic was (of course) all the HBBer's we've never met -- which means, ALL of them except az_lender and NYCityBoy. The only negative things we had to say were about the extremists who are buying mainly guns and ammo. Popcorn was not on the menu at Gente, but we send our regards to Neil and hope that his party is as much fun as ours. I have to admit I poked fun at NYCityBoy's Minnesota accent. Even though I knew he was from MN, I had automatically supposed he would talk like a New Yorker. (I'm from Phila and don't sound much like Maine or AZ.)

Got popcorn?

Neil

Sunday, September 16, 2007

Don't be afraid to sell home alone

If you are here to RSVP for the blogger party/dinner, please go down to the previous article. :)

Funny thing, the online article is much more pro REIC than the "dead tree" article.

A quote: "Even better, in Grant's view, was the fact that he didn't have to pay a real estate broker's commission, which typically runs 5% to 6% of the sale price and is split between the buyer's agent and the seller's agent. Grant ended up saving $80,000 to $96,000."

"article"

What happens when more people realize how expensive it is to go through a realtor? That 6% commission is outrageous!

"Yet, even when home sellers do it themselves, there is no free lunch, the DiMassas learned. When they arranged to list their condo on the MLS, the DiMassas had to abide by an MLS rule that requires paying a commission to any agent who brings a buyer. In their case, they offered 2.5% of the sale price and ended up paying about $20,000."

Ok, if there is a buying agent, pay 2.5%. That's fair. If there isn't one, the buyer should demand a 2.5% discount.

This is going to take a long time. But if the LA times is publishing it, J6P already has heard a little about it.

Got popcorn?

Neil

Funny thing, the online article is much more pro REIC than the "dead tree" article.

A quote: "Even better, in Grant's view, was the fact that he didn't have to pay a real estate broker's commission, which typically runs 5% to 6% of the sale price and is split between the buyer's agent and the seller's agent. Grant ended up saving $80,000 to $96,000."

"article"

What happens when more people realize how expensive it is to go through a realtor? That 6% commission is outrageous!

"Yet, even when home sellers do it themselves, there is no free lunch, the DiMassas learned. When they arranged to list their condo on the MLS, the DiMassas had to abide by an MLS rule that requires paying a commission to any agent who brings a buyer. In their case, they offered 2.5% of the sale price and ended up paying about $20,000."

Ok, if there is a buying agent, pay 2.5%. That's fair. If there isn't one, the buyer should demand a 2.5% discount.

This is going to take a long time. But if the LA times is publishing it, J6P already has heard a little about it.

Got popcorn?

Neil

Friday, September 14, 2007

Bubble blog meeting! Sunday 9/30/2007

The date and time are fixed. Yes, I'll keep doing minor edits to the post.

Current count: 34+

I've received quite a few e-mail RSVP's, so I'm behind on updating and other duties call. So expect an update by 10pm PST

No reason why more couldn't be merrier!

Note: I'm changing the sign to say "Blogger Party." :)

I'm certainly getting excited about meeting fellow bloggers.

Where: Cheesecake factory in Redondo Beach at 6pm.

It will be fun!

Please RSVP. I'd love to put names with faces. Maybe even learn real names!

Bring significant others, friends, etc. Just give me an idea of how many.

Directions:

Cheesecake Factory (It was a REIC hangout during the boom, so schadenfreude)

605 N Harbor Dr

Redondo Beach, CA 90277

From the IE, take your favorite freeway to the 405N (say 91, cut over to 405N)

Exit Hawthorne Blvd. You will take a left off the exit and another left to actually get onto Hawthorne. Right onto 190th street and a left onto Beryl (west). When Beryl ends turn right. If you cannot see the Cheesecake factory, get a new optometrist. ;)

Or... use google/maps, mapquest, or whatever your favorite mapping software is. If you can find this site you can probably do a printout of a map. ;)

How to recognize me... I'm 6', brown hair... forget it. I'm make a sign that says "HBB". :) For those that prefer e-mail: wannabuy3@gmail.com or leave a contact, I'll give more info. If you are e-mailing, I'm assuming its because you prefer not to broadcast on the WWW, so leave me a name you're ok with me posting. (Or it can be anon#4 +1, anon#5, anon#6, etc.) I'd prefer a name so that I can track cancellations. (They'll happen and that's cool. I'm just trying to keep everyone informed.)

I'll try to show up early and be in the bar patio. Why there? You can see people entering and I'll try to have the "HBB" sign obvious from the entry (turn a 180 from the entry doors and I'll try to sit in a visible area).

Deep though, think how much the markets are going to change between now and the party/dinner. Where will the stock market be? Will the commercial paper market be in a more publicly obvious decline that even J6P understands?

If you want to bring things to discuss, please make copies! For example, I have a series of excel files with graphs that might be interesting to discuss in person, but I do not consider a long enough timeline to post on the web. (You've seen small portions on the blog.) Or... just bring yourself! I envision this to be a mostly relaxed meet and greet, not a stockholders meeting. ;)

Got popcorn and some time?

Neil

Current count: 34+

I've received quite a few e-mail RSVP's, so I'm behind on updating and other duties call. So expect an update by 10pm PST

No reason why more couldn't be merrier!

Note: I'm changing the sign to say "Blogger Party." :)

I'm certainly getting excited about meeting fellow bloggers.

Where: Cheesecake factory in Redondo Beach at 6pm.

It will be fun!

Please RSVP. I'd love to put names with faces. Maybe even learn real names!

Bring significant others, friends, etc. Just give me an idea of how many.

Directions:

Cheesecake Factory (It was a REIC hangout during the boom, so schadenfreude)

605 N Harbor Dr

Redondo Beach, CA 90277

From the IE, take your favorite freeway to the 405N (say 91, cut over to 405N)

Exit Hawthorne Blvd. You will take a left off the exit and another left to actually get onto Hawthorne. Right onto 190th street and a left onto Beryl (west). When Beryl ends turn right. If you cannot see the Cheesecake factory, get a new optometrist. ;)

Or... use google/maps, mapquest, or whatever your favorite mapping software is. If you can find this site you can probably do a printout of a map. ;)

How to recognize me... I'm 6', brown hair... forget it. I'm make a sign that says "HBB". :) For those that prefer e-mail: wannabuy3@gmail.com or leave a contact, I'll give more info. If you are e-mailing, I'm assuming its because you prefer not to broadcast on the WWW, so leave me a name you're ok with me posting. (Or it can be anon#4 +1, anon#5, anon#6, etc.) I'd prefer a name so that I can track cancellations. (They'll happen and that's cool. I'm just trying to keep everyone informed.)

I'll try to show up early and be in the bar patio. Why there? You can see people entering and I'll try to have the "HBB" sign obvious from the entry (turn a 180 from the entry doors and I'll try to sit in a visible area).

Deep though, think how much the markets are going to change between now and the party/dinner. Where will the stock market be? Will the commercial paper market be in a more publicly obvious decline that even J6P understands?

If you want to bring things to discuss, please make copies! For example, I have a series of excel files with graphs that might be interesting to discuss in person, but I do not consider a long enough timeline to post on the web. (You've seen small portions on the blog.) Or... just bring yourself! I envision this to be a mostly relaxed meet and greet, not a stockholders meeting. ;)

Got popcorn and some time?

Neil

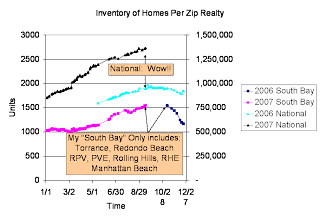

Inventory everywhere

Quite a while ago I predicted inventory, per Ziprealty, would peak at 1.3 to 1.4 million homes in 2007. We are already there! 1,366,352 homes are on the market this morning; that is a new record. Note that it is only 6,000 above 8/28/2007, so we are growing slowly. However, as I predicted in the previous article, we're not done yet in 2007. The peak should be later (partially due to the credit crisis). In a way its comforting to see things unfold in a predictable manner. Do note how I split 2006 and 2007 in the chart above in order to more clearly show the YOY (year over year) difference.

http://recomments.blogspot.com/2007/02/going-out-on-limb-inventory.html

Due to the credit crisis, home sales should continue to drop in a YOY basis. If you haven't read OCrenter's excellent Bubble Market Inventory blog (in links), you should. Hattip for providing to the public domain the data for all the bubble markets, including LA, for years; the public service is beyond value. I've taken the end of month inventory and divided it by each month's sales to create the inventory in months of sales. As you can see, during crazy 2005, there really wasn't much inventory. In 2006 the inventory to sales started in a normal range and then went a little high. Now in 2007 we have just gotten into break away inventory. Instead of August competing with June to be the best sales month of the year, August was the weakest sales month (so far) of 2007. Gulp.

When I do the market emotions in a week, I fully expect us to continue being in "fear." Yes, some regions are far worse. When will people wake up to all of the empty homes that are flips? 90277 is absolutely littered with them. I wish 90275/90274 were also, but I'm not seeing that... yet.

My wife's latest concern is that we won't be able to get a mortgage for the amount we could have six months ago. I'm not sure my response of "that would be the best thing for us" has convinced her.

Last thing:

HBB meeing in the South Bay on Saturday 9/29/2007. Anyone interested? I was suggesting the Cheesecake Factory in Redondo Beach. Nice location, good schadenfreude. I'd like to put a face with some of the names. Please responds in the "weekend topics" of HBB.

http://thehousingbubbleblog.com/?p=3413

Got popcorn?

Neil

Thursday, September 13, 2007

Hovnanian home sale this weekend

http://tinyurl.com/2ua5ye

or piece together:

http://money.cnn.com/2007/09/13/

real_estate/hovnian_discounts.ap/

index.htm?postversion=2007091317

These discounts are pretty impressive. (Not that I'm tempted). Any bets on how many they sell? I'm guessing a nice round 100 units.

My favorite quote from the article: "Skea said the sale would not be repeated, but an industry observer was not so certain."

As much as it is cheesy marketing tactics, do understand builders have to try to survive. If this marketing helps... so be it. I'm tired of trying to warn the sheeple; just good luck finding enough who qualify for the mortgage! ;)

This is just more knife catching.

Read this article (hat tip Sacramento landing):

http://www.usatoday.com/money/economy/housing/2007-09-12-affordability_N.htm

Or http://tinyurl.com/2mzprw

Look at the last table. Of the New Jersey/New York/Long Island home owners 21% are paying over 50% of income towards their housing. That is unsustainable.

Then look at the bay area at 23% and LA at 24%. Look at how much money the central banks are pouring into the banks (per below $383 Billion in August, an unprecedented amount).

http://www.minyanville.com/articles/

banks-chavez-cents-risk-debt-credit/index/a/14089

or

http://tinyurl.com/2rvdsp

Upping Freddie and Fannie's limits just will not do much. Foreign banks/hedge funds/governments are going to want reasonable security in their investments. We could make it bad enough that the GSE's cannot sell bonds... Oh wait... now when was Fannie's last Auction... Hmmmm...

And I'm sure J6P is happy oil is now over $80/bbl. Good grief! How are the airlines (an industry I love to follow) going to survive? Sigh... :(

http://biz.yahoo.com/ap/070913/oil_prices.html?.v=23

Got popcorn?

Neil

or piece together:

http://money.cnn.com/2007/09/13/

real_estate/hovnian_discounts.ap/

index.htm?postversion=2007091317

These discounts are pretty impressive. (Not that I'm tempted). Any bets on how many they sell? I'm guessing a nice round 100 units.

My favorite quote from the article: "Skea said the sale would not be repeated, but an industry observer was not so certain."

As much as it is cheesy marketing tactics, do understand builders have to try to survive. If this marketing helps... so be it. I'm tired of trying to warn the sheeple; just good luck finding enough who qualify for the mortgage! ;)

This is just more knife catching.

Read this article (hat tip Sacramento landing):

http://www.usatoday.com/money/economy/housing/2007-09-12-affordability_N.htm

Or http://tinyurl.com/2mzprw

Look at the last table. Of the New Jersey/New York/Long Island home owners 21% are paying over 50% of income towards their housing. That is unsustainable.

Then look at the bay area at 23% and LA at 24%. Look at how much money the central banks are pouring into the banks (per below $383 Billion in August, an unprecedented amount).

http://www.minyanville.com/articles/

banks-chavez-cents-risk-debt-credit/index/a/14089

or

http://tinyurl.com/2rvdsp

Upping Freddie and Fannie's limits just will not do much. Foreign banks/hedge funds/governments are going to want reasonable security in their investments. We could make it bad enough that the GSE's cannot sell bonds... Oh wait... now when was Fannie's last Auction... Hmmmm...

And I'm sure J6P is happy oil is now over $80/bbl. Good grief! How are the airlines (an industry I love to follow) going to survive? Sigh... :(

http://biz.yahoo.com/ap/070913/oil_prices.html?.v=23

Got popcorn?

Neil

Wednesday, September 12, 2007

Tire shards

I've been having to go up to Palmdale a bit lately (thankfully counter-traffic). What I cannot help but notice is the huge quantity of tire fragments on the road. Is this due to the heat? Those malfunctioning Chinese tires? Or are people trying to save a buck and riding on worn out tires for a mile too many? I do not have a direct YOY comparison, so I'll have to withhold judgment. But if anyone has a link to a web page describing any trend on vehicle safety due to people being stupidly cheap on tire replacement, I would love to peruse.

Got popcorn?

Neil

Monday, September 10, 2007

How to talk with your realtor

Remember, in their own mind, they make sense.

For my niece and nephew (Yes, they would get it):

Why the change? I just cannot take the same counter arguments!

Its different here.

RE always goes up.

But all of the baby boomers wan to live here.

If on the REIC could put as much thought into their pitches as Monte Python. Sigh...

Got popcorn?

Neil

For my niece and nephew (Yes, they would get it):

Why the change? I just cannot take the same counter arguments!

Its different here.

RE always goes up.

But all of the baby boomers wan to live here.

If on the REIC could put as much thought into their pitches as Monte Python. Sigh...

Got popcorn?

Neil

Friday, September 07, 2007

Proverbial invisible hand

What we're seeing is a delayed implementation of Adam Smith's invisible hand. While the American consumer has been resilient, I'm expecting that to slow. Credit will continue to tighten.

So the question is, with all of the trouble in the commercial paper market, how long can the "no payment until 2009" promotions last? J6P is up to his eyeballs in debt. Soon that negative savings rate has to be paid off.

From what I've read, our current demographics suggest a 3% savings rate would be the minimum for a healthy long term economy. Cool... Now what does it have to go up to? We have years of negative savings that must be made up. We also will be seeing the land barrons' retirement plan of stiffing the next generation for a home isn't working out... So how much must spending contract?

What won't be hit? I'm sure sporting goods will be very hard hit (how many people do not have three rackets in the garage?). Cars sales are one step away from the critical list. Yes, retirees will spend more time on leisure, but do we really need that many golf courses?

What will it be like on the ski slopes this year? Will people nurse an extra year out of their old skis? Not by as many day passes? Go with cheaper lodging if they have a season pass? (Its a damn expensive sport.) Not to mention, what are the bar sales going to be like at Mammoth this year? Quite bluntly, the realtors (tm) and mortgage brokers were the lushes for 2003, 2004 and 2005. You're going to get a few blog posts on this during the winter from yours truly. ;)

I have a feeling that the election focus will shift to health care, pensions, and 401k reform. The boomers are getting ready to retire and are not ready to accept the losses their portfolios are about to take. How many hedge funds haven't yet halted dispersals yet are effectively broke? Yes, I'm sure some will do well. But not all.

Closer to my heart, will business jet sales bonanza continue? Heck, even single engine prop jobs were selling well. But I cannot help but notice how many older Cessnas, pipers, and Commanders are on the market. But no flood of jets... yet. I think we're just seeing the normal time lag; the rich don't notice we're into a recession until about a year after the working class.

Overall my predictions are that we're going to see a bit of layoffs between now and just before Christmas. Nothing too severe, but enough to get people worried. That won't happen until 2008.

Bubble bloggers have been frustrated for years why the laws of economics were no longer applying. We're about to find out why people still read Adam Smith. May I recommend an earlier printing? One with the chapter on slavery (its really a good overview on how treatment of workers and their motivation affects productivity). For some reason the newer printings cut out that section. Also spend some time on the chapters on how regions do best focusing on specialized industries (e.g., so-cal and banking/aerospace/media). Yea... he uses lace production as an example, but no reason you cannot think software, health care management, or microchips. ;)

The WSJ has a pretty bearish video:

http://online.wsj.com/public/page/8_0004.html

"Value of a home depends on the employment around it." Naaaa... couldn't be.

"Unless we have see some pronounced evidence of firming of the labor market, of which there is no evidence, consumer spending is likely to slow."

In other words, Goldilocks is about to suffer a bit of abuse.

Got popcorn?

Neil

So the question is, with all of the trouble in the commercial paper market, how long can the "no payment until 2009" promotions last? J6P is up to his eyeballs in debt. Soon that negative savings rate has to be paid off.

From what I've read, our current demographics suggest a 3% savings rate would be the minimum for a healthy long term economy. Cool... Now what does it have to go up to? We have years of negative savings that must be made up. We also will be seeing the land barrons' retirement plan of stiffing the next generation for a home isn't working out... So how much must spending contract?

What won't be hit? I'm sure sporting goods will be very hard hit (how many people do not have three rackets in the garage?). Cars sales are one step away from the critical list. Yes, retirees will spend more time on leisure, but do we really need that many golf courses?

What will it be like on the ski slopes this year? Will people nurse an extra year out of their old skis? Not by as many day passes? Go with cheaper lodging if they have a season pass? (Its a damn expensive sport.) Not to mention, what are the bar sales going to be like at Mammoth this year? Quite bluntly, the realtors (tm) and mortgage brokers were the lushes for 2003, 2004 and 2005. You're going to get a few blog posts on this during the winter from yours truly. ;)

I have a feeling that the election focus will shift to health care, pensions, and 401k reform. The boomers are getting ready to retire and are not ready to accept the losses their portfolios are about to take. How many hedge funds haven't yet halted dispersals yet are effectively broke? Yes, I'm sure some will do well. But not all.

Closer to my heart, will business jet sales bonanza continue? Heck, even single engine prop jobs were selling well. But I cannot help but notice how many older Cessnas, pipers, and Commanders are on the market. But no flood of jets... yet. I think we're just seeing the normal time lag; the rich don't notice we're into a recession until about a year after the working class.

Overall my predictions are that we're going to see a bit of layoffs between now and just before Christmas. Nothing too severe, but enough to get people worried. That won't happen until 2008.

Bubble bloggers have been frustrated for years why the laws of economics were no longer applying. We're about to find out why people still read Adam Smith. May I recommend an earlier printing? One with the chapter on slavery (its really a good overview on how treatment of workers and their motivation affects productivity). For some reason the newer printings cut out that section. Also spend some time on the chapters on how regions do best focusing on specialized industries (e.g., so-cal and banking/aerospace/media). Yea... he uses lace production as an example, but no reason you cannot think software, health care management, or microchips. ;)

The WSJ has a pretty bearish video:

http://online.wsj.com/public/page/8_0004.html

"Value of a home depends on the employment around it." Naaaa... couldn't be.

"Unless we have see some pronounced evidence of firming of the labor market, of which there is no evidence, consumer spending is likely to slow."

In other words, Goldilocks is about to suffer a bit of abuse.

Got popcorn?

Neil

Monday, September 03, 2007

Weekend conversations

There were several weekend conversations that are worth blogging.

First, it was the opening weekend for USC football!

The organizer of our football group has now had his home on the market 9 or 10 months. (It was on the market a month or so before the Rose bowl!) He's holding off moving for a great promotion trying to sell. (Internal transfer.)

Another bought a condo (townhouse?) in Silver lake. She's renting that out (obviously a loss) but was able to find a rental on the east side of PCH in Malibu for less. So she brags about the rent difference but ignores the mortgage.

We sat across from a builder "marketer" at the beach cities tailgate (my favorite). He was noting how prices would continue to go down a little. He did gripe about a bunch of $4.6 million homes in the bay area with boat docks (for 46' boats, I guess they expect $100k/foot for the dock) that no one is looking at. He's worried; with a recently purchased Marina Del Rey condo, where is the income going to come from? He's fine today... but tomorrow?

Breakfast at my favorite diner is always fun. Next to us was a baby boomer bragging about his home sale and how cheap it was to rent by the beach. "I probably won't ever buy a home again" was heard by at least half of the restaurant. He was excited about a possible low cost Hawaiian rental too; he was trying to figure out a way to rent it in his name and "time share" it between his buddies at the table.

Dinner with family was fun. Lafite Rothschild (1975) wine also helped lubricate the conversation. One uncle listened and determined no area was safe from the downturn (the one who could afford to bring the name brand wine). Another uncle was arguing vigorously how prices will, at most, go down a little. (I decided to let it drop until his bought of unemployment goes away...) The first uncle understood job migration (he cannot hire staff for his office due to migration out of CA). The second was "people will always want to live here." The first uncle agreed with my comment that "we have to undo and redo three years worth of sales." The 2nd uncle just wasn't willing to accept any such possibility.

Basically, buyers have written off buying. Sellers... hope but fear. People whom consider their equity their pride and joy... will take a hit. I should note that the 1st uncle's home is a custom job designed for one purpose: sunset views during retirement with an elevator for when the knees go. Market price to him is something his executor will worry about. The 2nd uncle... I think his retirement planning is based on "cashing out" of high home equity...

I keep reading predictions of single digit declines in 2007, 10% to 20% in 2008, and then the floor falling out in 2009. We seem to be on track for that. At least emotionally. But I wonder, when will all the flips in bubble areas soak up too many funds for the mother markets? Not to mention, am I the only one noticing the number of retail and commercial "for lease" signs is abnormal?

Got popcorn?

Neil

First, it was the opening weekend for USC football!

The organizer of our football group has now had his home on the market 9 or 10 months. (It was on the market a month or so before the Rose bowl!) He's holding off moving for a great promotion trying to sell. (Internal transfer.)

Another bought a condo (townhouse?) in Silver lake. She's renting that out (obviously a loss) but was able to find a rental on the east side of PCH in Malibu for less. So she brags about the rent difference but ignores the mortgage.

We sat across from a builder "marketer" at the beach cities tailgate (my favorite). He was noting how prices would continue to go down a little. He did gripe about a bunch of $4.6 million homes in the bay area with boat docks (for 46' boats, I guess they expect $100k/foot for the dock) that no one is looking at. He's worried; with a recently purchased Marina Del Rey condo, where is the income going to come from? He's fine today... but tomorrow?

Breakfast at my favorite diner is always fun. Next to us was a baby boomer bragging about his home sale and how cheap it was to rent by the beach. "I probably won't ever buy a home again" was heard by at least half of the restaurant. He was excited about a possible low cost Hawaiian rental too; he was trying to figure out a way to rent it in his name and "time share" it between his buddies at the table.

Dinner with family was fun. Lafite Rothschild (1975) wine also helped lubricate the conversation. One uncle listened and determined no area was safe from the downturn (the one who could afford to bring the name brand wine). Another uncle was arguing vigorously how prices will, at most, go down a little. (I decided to let it drop until his bought of unemployment goes away...) The first uncle understood job migration (he cannot hire staff for his office due to migration out of CA). The second was "people will always want to live here." The first uncle agreed with my comment that "we have to undo and redo three years worth of sales." The 2nd uncle just wasn't willing to accept any such possibility.

Basically, buyers have written off buying. Sellers... hope but fear. People whom consider their equity their pride and joy... will take a hit. I should note that the 1st uncle's home is a custom job designed for one purpose: sunset views during retirement with an elevator for when the knees go. Market price to him is something his executor will worry about. The 2nd uncle... I think his retirement planning is based on "cashing out" of high home equity...

I keep reading predictions of single digit declines in 2007, 10% to 20% in 2008, and then the floor falling out in 2009. We seem to be on track for that. At least emotionally. But I wonder, when will all the flips in bubble areas soak up too many funds for the mother markets? Not to mention, am I the only one noticing the number of retail and commercial "for lease" signs is abnormal?

Got popcorn?

Neil

Subscribe to:

Posts (Atom)