This is the time of year that the real estate market is in a transition from the Spring selling season to the summer selling season. Typically, 'knowledge workers' surge to put their homes on the market starting two weeks before school lets out to a few weeks after school lets out. So there is typically an inventory lull right now. A break if you will and we're seeing that in all of the inventory.

Sales data comes out next week and the week after. So I'm not going to discuss that as much as I planned. Basically, the forward looking indicators are up compared to a month ago. I still believe the stats are not pretty... But as best I can tell we're taking a few branches off the fall from the ugly tree; in other words, the market isn't pretty, but the fund injections seem to have delayed the day of reckoning from the inventory side.

Can we afford homes by historical standards? Let's start by looking at afford ability. Wells Fargo has been calculating this the same way for an extended period of time. Search through their archives and you can find data going back decades:

http://www.nahb.org/page.aspx/category/sectionID=135

Some areas are improving in the sustainability of homes. But none are back at the historical norm. If you look at the link, median incomes have gone up only gone up a bit since 2000.

Now what about Case-Shiller?

You can see that by historical measures, prices are still high but as a group everything is falling. There is not one city in the 20 monitored that hasn't lost value in the last six months. Only three remain at 200% or more of their January 2000 prices. To think, incomes have only gone up by ~20%... That implies more correction is required. Some of the 'less bubbly' areas saw incomes remain flat, so that isn't necessarily good.

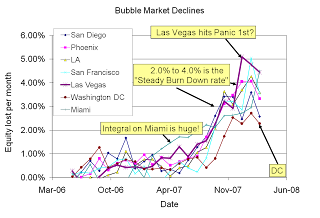

I like to plot the trend of price drops per month in a number of markets. What we see is a flattening off in the price drops. Basically in the 2.0% to 4.0% range with two outliers in Las Vegas and the Bay Area. I could only speculate on the SF Bay Area at this point. Las Vegas is so overbuilt that it was doomed to an extraordinary collapse.

But notice something about DC. Of the large markets identified as bubble markets, it looks like it is having the least pain. Its quite possible that it has matured into a large enough urban area that the fraction of the population that can afford a home has dropped (a la LA, NYC, and the bay area). I could only speculate on where its final affordability plateau will be; but I do not expect it to ever hit 80% again! (Yes, a bear stating a city might have moved to a new threshold.) Where? Its not ready to hit LA's 50% upper bound. Not this cycle. Perhaps prices will stop their decent at 60% to 70% affordability.

But then consider LA... If any city has a risk of breaking the pattern and going to very fast price declines, it would be the least affordable city in the nation (world?).

National Inventory

National Inventory Its ugly, but it hasn't yet broken into uncharted territory. Its unseasonal... and scary. Note: Ziprealty only covers about 1/3rd of the homes for sale.

LA, in the south Bay

LA, in the south Bay

Inventory isn't break away... but its high. This is a classic area where traditionally the inventory builds up pretty quickly as the kids are about to leave school. So now that I know to look for that phenomenon... I'll make sure to get a few data points a week this year! I'm amazed at how fast home prices have been dropping despite inventory not being as super high levels. I think that single digit affordability and banks now having to verify loan qualifications might just be doing the damage. Probably the same effect is being seen in the SF Bay Area.

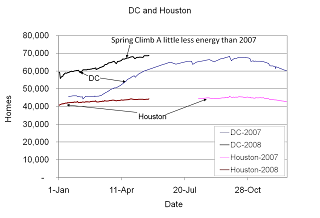

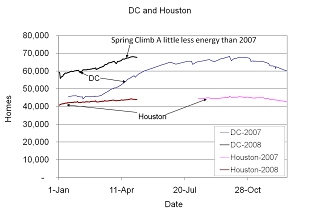

DC and Houston Houston is easier: Its income has been flat for 7 years, but so were prices (ok, Dallas is up 20%... Nearest city in Case-Shiller)

DC has high inventory too. But the distribution is interesting. I project that 2.5% to 3.0% price declines per month will be standard for a while until afford ability breaks 50%.

Arlington

Arlington What about that distribution of inventory? Its still high inside the beltway. I pick Arlington because ziprealty data and MRIS data align (they do not for Alexandria city).

The inventory would be high on its own, but not extreme. But there is that large outside the beltway inventory that is becoming attractively priced. This is worth watching.

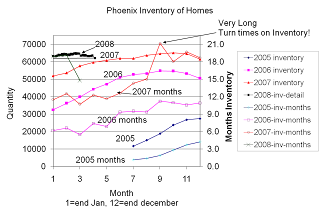

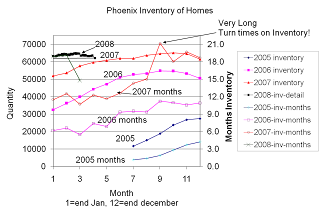

Phoenix Phoenix was late to the game, shot up quickly, and is now plunging back down to earth. While the mega inventory is no longer flirting with multi-year levels, until Phoenix can pull inventory below a year, its price declines will continue to hover at high levels. But afford ability is lurking. The big unknown with Phoenix is that so much of its employment is tied to growth. With another year of slowing growth ahead... do we have a death spiral a la Las Vegas?

That's it for this weekend. (Ok, 00:20 Monday...)

In quick summary, inventory remains high, but below record levels. We're seeing the normal early May drop in inventory but we should expect to see a ramp up of inventory until the end of the summer selling season in most areas. Case-Shiller is pointing to rapid declines in similar home prices. I'll be very curious to see if there is any 'spring bounce' break in the price declines.

Overall, its a waiters market.

We're not seeing any signs of a turn around. If anything, its only evidence that the rate of pain increase has halted.

Got Popcorn?

Neil