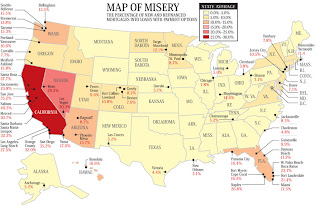

You've probably seen the "Map of Misery before." It details where the sub-prime "Option ARM" mortgages were issued. Why does it matter? It shows which regions had home prices shoot so far beyound incomes that people did really stupid loans to get into a house.

Ok, it also shows where rampant home speculation has occured. Don't think its happened in your neighborhood? Drive around, see how many homes are empty. Is it a flip? Well... is the flooring under the washer and drier new? If so, in my opinion, its a flip. Let's face it, who actually lives in a place and doesn't use the washer and drier? If they never spilled anything there, they are a much more dexterious person than I'll ever be.

There is a new blog on real-estate affordability. Unfortunately, the data is quarterly and thus there is a time delay between when the data is received and then published. Cest la vie:

http://www.housingtracker.net/affordability/

Let us take a look into Los Angeles. In 3Q 2006 the price to rent was 332X. Ok, Los Angeles never gets down to a price to rent of 120 to 150 (normal market) or the 110 that is the supposid traditional end of a RE drop. So it comes down to, who can afford to live in LA?

I know my employer is having to consider moving departments out of state. Our competition relocated a thousand already and a similar number is scheduled. Thus, it implies my industry is priced out.

But we pay above the local median wage! Thus, this implies that a large fraction of the LA workforce is "priced out forever." Ok, its normal in LA for the bottom 40% to 60% to have no hope of owning. Bummer... but that's the fact. But when its the bottom 80%? Watch the middle class leave.

So what will happen to our tax base in 2007 and 2008? Yep... shrink. And do pay a visit to CR's blog and note how quickly construction jobs are going to go "poof." Jobs that do not show up in unemployment statistics due to the fact that they are "independent contractors." Notice he forcasts a drop in March, April, and May. A pretty steep drop.

So who is going to stick around? Who's going to leave? And who is going to hold onto a home where they owe 110% of the purchase price AND the market has dropped 10%+? The "Map of misery" is about to become the map of foreclosures.

Anyone who bought in 2006 is well underwater. Unless they put 20%+ down, there is no reason to protect their credit (its just far too expensive to do so). If they option ARM'd their equity away (or HELOC'd, Refied, etc.), they'll bail too. We can safely predict that 20%+ of 2006 sales will be back on the market, soon. 2005? They'll be underwater not too far behind. 2004 sales? They'll be underwater by fall. 2003? By spring 2008. 2002? By summer 2008. What's your prediction? When will it stop?

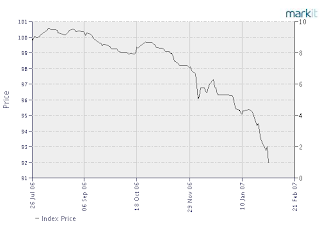

Due to the amount of stock margined to invest in RE, its going to hit Wall Street too. I'm trying to find the stats on that. Please post links if you have them!

One tidbit, Fortune 500 moves are slow to plan and execute. Nissan showed a lot of foresight. By the time anyone else moves, we'll be in a steep decline. But my employer needs to see a large drop in prices to justify keeping some divisions in state. Once the decision to move has been made, its too late to stop the wheels (buildings would have been bought and sold, moving contracts signed, etc.). Thus, we'll have jobs exiting state right just as the proverbial stuff hits the fan.

Most of my life I've been far more optimistic on everything. Economically, I can't believe how much of a bear I am. But the facts... don't show a sudden influx of young entering California; the opposite is happening. It takes those young to foster the next generation of high wage industries. Sigh... They'll be in Pheonix, Vegas, Austin, etc.

This is going to be a very long downturn for Califonia. Worse... if property values drop in Florida or Hawaii, that's where forign money will go. (Better weather or at least closer proximity.)

Got popcorn?

Neil

First, a hat-tip (again!) to CR:

First, a hat-tip (again!) to CR: