It just feels like we are 4 to 12 weeks away from a "big financial event." This is the result of the increasing "risk premium" being seen in all financial markets. Quite frankly, the current system is set up for a negligible risk premium. That risk premium (or risk aversion) will only grow over the next few weeks.

Head over to calculated risk as they talk about the 3rd Bear Stearns hedge fund to halt disbursements. We all know what was left from the first two... This is going to

A link for the only good "Hedge fund implode-o-meter" I know of:

http://wasatchecon.blogspot.com/2007/06/hedge-fund-failometer.html

I just cannot imagine "the rich" doing without their jets, clothes, vacations, etc. So when liquidity becomes precious, they'll rush towards it. I still remember a friend's glee as he tracked the sultan of Brunei's cash flow issues post Gulf war I. ;) Can we say "high end fire sale?"

I am predicting that the meltdown in subprime will really start to hurt real estate closings in September. This is probably not enough... but the slow down in the LBO market might be...

Either way, I'm thinking J6P gets his wake up call in September or October. No later.

I've also decided to completely shut up about finance at work or with friends. I'm tired of being Mr. Doom. Its too late to save them; at this point I'll only give them something to hate me for. I know people who left our work to seek employment with yacht builders; maybe not the best time in the economic cycle for such a decision?

If you haven't read "The Hungry Years," consider it. Its very depressing. But it does a good job of describing how jobs were shed in the great depression. Ouch.

Thankfully the one coworker who did listen just entered escrow on selling his home! He's dutifully cut his asking price 5% every couple of weeks (he couldn't quite make himself do it every week). He actually ended up with a *tiny* bidding war. (Two buyers, one just out did the other. 1st buyer refused to increase the bid.

Its too late to stop this. I don't think the crash will occur in August...

But the Nikkei, Hang Seng, and Jakarta composite aren't exactly doing hot tonight.

http://finance.yahoo.com/intlindices?e=asia

Got popcorn?

Neil

Tuesday, July 31, 2007

Monday, July 30, 2007

Flip this house; a reason to like the show

Yesterday there was a "flip this house" and "housing ladder" marathon. The wife fell asleep in front of the TV while this was on. I've learned to let her sleep and leave the TV alone (and do housing blogs). :) But for an odd reason I really like those shows now.

Why? Two episodes on Houston Texas. You see, my company has *large* land options there. We're constantly one contract away from sending a few thousand engineers there. (We never seem to earn *that* contract.) So far the wife has been adamant about staying in southern California.

But after seeing two different five bedroom homes being flipped... flips that flopped at $210 and some other low value... She's now more receptive to relocating. I was just online. A 4 bedroom 3 bath in the 3,000 sqft range *on the water* is about $450k to $550k. Wow! No wonder so many engineers at work like the idea. Yea... she somehow seems asleep yet can watch TV... I just accept it. :)

And prices in Houston are declining...

Now, I don't want to move. But at some point I'm going to give up on waiting. (At some point my savings will let me buy the Houston home cash.) But if these shows awaken people to affordable areas... watch out. The flood gates will open.

I'm still amazed at how the "background" financial institutions that support mortgages are falling apart and yet J6P knows nothing...

What's the point of this post? Due to the extreme costs of California housing, the willingness to stay in the state can disappear quickly. I think the exodus will be like the 1990's where many who would like to leave won't be able to.

Got popcorn?

Neil

Why? Two episodes on Houston Texas. You see, my company has *large* land options there. We're constantly one contract away from sending a few thousand engineers there. (We never seem to earn *that* contract.) So far the wife has been adamant about staying in southern California.

But after seeing two different five bedroom homes being flipped... flips that flopped at $210 and some other low value... She's now more receptive to relocating. I was just online. A 4 bedroom 3 bath in the 3,000 sqft range *on the water* is about $450k to $550k. Wow! No wonder so many engineers at work like the idea. Yea... she somehow seems asleep yet can watch TV... I just accept it. :)

And prices in Houston are declining...

Now, I don't want to move. But at some point I'm going to give up on waiting. (At some point my savings will let me buy the Houston home cash.) But if these shows awaken people to affordable areas... watch out. The flood gates will open.

I'm still amazed at how the "background" financial institutions that support mortgages are falling apart and yet J6P knows nothing...

What's the point of this post? Due to the extreme costs of California housing, the willingness to stay in the state can disappear quickly. I think the exodus will be like the 1990's where many who would like to leave won't be able to.

Got popcorn?

Neil

Friday, July 27, 2007

Update on my prediction on inventory

In this old post I predicted national real estate inventory would peak at 1.3 to 1.4 million units in 2007 per ziprealty.com.

Go to zip realty

click on "buy a home"

click on "search for homes"

The current number is 1,298,636.

Last year the peak, by my tracking, was on September 20th at 987,601.

So I'm comfortable with the 1.3 million being broken. Believe it or not, I thought that was really bearish.

Note: my best SWAG is that ziprealty added about 10% more "region" so that some of the growth is just expanded areas.

I'm glad I didn't make a prediction on South bay inventory (here in LA). Inventory has stalled. I'm confused as to why... But I accept its going to be a multi-year process. Why didn't I make a prediction? I really didn't start tracking it with enough resolution until November. However, bearmasters' excellent blog (my last link) does an excellent job of that.

I love bloomberg news right now! (On the TV as background)

"Traders cannot wait for the weekend."

They are quoting a very bearish trader from Chicago (missed the name). He's pointing out to be really careful buying into this market.

He's also pointing out that a huge fraction of the late day trading is the investment banks doing huge purchases with net selling by others. He's also knowing that the bulls have been buying every dip, but if the downward momentum continues bulls will have no choice but to sell. (Can we say margin call.)

He ended with the advice that the bears are going to be in control for a while. Bwaa haa ha! (oops, out loud). I'm actually a really nice person... but this is like the dotcom bubble... just stupid and dangerous. Its time to end the mal-investment and re-divert recourses to new industries.

Prediction of $80/bbl oil in "A week to 10 days." Gulp!

Got popcorn?

Neil

Go to zip realty

click on "buy a home"

click on "search for homes"

The current number is 1,298,636.

Last year the peak, by my tracking, was on September 20th at 987,601.

So I'm comfortable with the 1.3 million being broken. Believe it or not, I thought that was really bearish.

Note: my best SWAG is that ziprealty added about 10% more "region" so that some of the growth is just expanded areas.

I'm glad I didn't make a prediction on South bay inventory (here in LA). Inventory has stalled. I'm confused as to why... But I accept its going to be a multi-year process. Why didn't I make a prediction? I really didn't start tracking it with enough resolution until November. However, bearmasters' excellent blog (my last link) does an excellent job of that.

I love bloomberg news right now! (On the TV as background)

"Traders cannot wait for the weekend."

They are quoting a very bearish trader from Chicago (missed the name). He's pointing out to be really careful buying into this market.

He's also pointing out that a huge fraction of the late day trading is the investment banks doing huge purchases with net selling by others. He's also knowing that the bulls have been buying every dip, but if the downward momentum continues bulls will have no choice but to sell. (Can we say margin call.)

He ended with the advice that the bears are going to be in control for a while. Bwaa haa ha! (oops, out loud). I'm actually a really nice person... but this is like the dotcom bubble... just stupid and dangerous. Its time to end the mal-investment and re-divert recourses to new industries.

Prediction of $80/bbl oil in "A week to 10 days." Gulp!

Got popcorn?

Neil

No Housing Turnaround for Two Years?

I love it when the MSM finally catches up. The *really* fun part is when the fundamentals point to rising home prices... but the MSM helps the sheeple push them down more. :) But that's years away:

http://biz.yahoo.com/bizwk/070727/jul2007db20070725384162.html?.v=2

First, it was the second half of 2007. Then it was 2008. Now analysts are saying the national housing market may not rebound until 2009

On July 25, the National Association of Realtors reported that sales of existing homes fell 3.8% in June to a seasonally adjusted annual rate of 5.75 million units, contributing to the bleak-and-getting-bleaker outlook.

Now, the rest of the article gives too much space to NAR spin... so the MSM isn't yet ready to accept the full story. Oh well. Wall street is interesting again today.

DJIA now is at: 13,354

Nasdaq: 2578

S&P: 1468

I'm quite surprised at a summer bear market. If this continues for much longer, it will gain a momentum of its own. It just might.

Now with the LBO market (KKR?) or mortgages get the credit for the drop?

But wait, Real estate only goes up!

(But man do coworkers want to get out to non-bubble markets.)

Got popcorn?

Neil

http://biz.yahoo.com/bizwk/070727/jul2007db20070725384162.html?.v=2

First, it was the second half of 2007. Then it was 2008. Now analysts are saying the national housing market may not rebound until 2009

On July 25, the National Association of Realtors reported that sales of existing homes fell 3.8% in June to a seasonally adjusted annual rate of 5.75 million units, contributing to the bleak-and-getting-bleaker outlook.

Now, the rest of the article gives too much space to NAR spin... so the MSM isn't yet ready to accept the full story. Oh well. Wall street is interesting again today.

DJIA now is at: 13,354

Nasdaq: 2578

S&P: 1468

I'm quite surprised at a summer bear market. If this continues for much longer, it will gain a momentum of its own. It just might.

Now with the LBO market (KKR?) or mortgages get the credit for the drop?

But wait, Real estate only goes up!

(But man do coworkers want to get out to non-bubble markets.)

Got popcorn?

Neil

Thursday, July 26, 2007

My Effin' birthday

Today is my birthday.

Had one of the worst days at work in years...

Let's put it this way, at the evening standup, I reported and left. When asked where I noted "Great Effin' birthday for me."

Don't do this unless you have coverage, bosses who like you, VP's who know your name (due to good work), etc.

It was one of those days.

But now its better. :)

So I'm just relaxing and celebrating with my wife. :)

She's cooking some wonderful rack of lamb, made my favorite cake, and otherwise is treating me wonderfully!

To my friend who gave us the bottle of Taittinger for the wedding. Its open and being consumed fast. My wife loves it! Thank you! I'm in heaven (sorry... I'm a budget wine snob). ;)

As to real estate and the economy... I don't think the market will crash during the summer. Come September or October... oh yea! If it crashes in July or August, I'm signing up for TJ's uber-bear class. ;)

I'm also moving my money out of the country (damn... some in time, some too late.. cest la vie). I'm thinking low cost providers of good quality alcohol. (Yea.... let's make investment decisions while consuming champagne...) Seriously though... when times get bad, people drink hard. Yes, top price products stop selling, but I'm betting two buck chuck sales go up 300%! (But is that enough to buy stock in Trader Joes???)

Dinner time!

Got popcorn? (not really on the menu tonight...)

Neil

Had one of the worst days at work in years...

Let's put it this way, at the evening standup, I reported and left. When asked where I noted "Great Effin' birthday for me."

Don't do this unless you have coverage, bosses who like you, VP's who know your name (due to good work), etc.

It was one of those days.

But now its better. :)

So I'm just relaxing and celebrating with my wife. :)

She's cooking some wonderful rack of lamb, made my favorite cake, and otherwise is treating me wonderfully!

To my friend who gave us the bottle of Taittinger for the wedding. Its open and being consumed fast. My wife loves it! Thank you! I'm in heaven (sorry... I'm a budget wine snob). ;)

As to real estate and the economy... I don't think the market will crash during the summer. Come September or October... oh yea! If it crashes in July or August, I'm signing up for TJ's uber-bear class. ;)

I'm also moving my money out of the country (damn... some in time, some too late.. cest la vie). I'm thinking low cost providers of good quality alcohol. (Yea.... let's make investment decisions while consuming champagne...) Seriously though... when times get bad, people drink hard. Yes, top price products stop selling, but I'm betting two buck chuck sales go up 300%! (But is that enough to buy stock in Trader Joes???)

Dinner time!

Got popcorn? (not really on the menu tonight...)

Neil

Wednesday, July 25, 2007

A tale of two meetings

Two meetings today, both turned into discussions on real estate.

First meeting: A group of mostly non-degreed support personnel.

It started with a discussion on why I haven't bought a home (everyone else in the meeting owned). After pointing out that the homes I'm looking at should drop $250k in two years... (no disagreement, they were willing to work 'on that theory') The comeback? "You missing out on the appreciation even if it declines."

"Not everyone has your prioritie; some people will buy anyway. Besides, with the weather here, how will prices ever go down?" (Note: every J6P agreed with this; despite the fact we had just talked about record foreclosures!)

I tried to point out that saving $1,200/month+ was enough to lease a new Mercedes every three years and pay all expenses on it... But somehow all of them were convinced buying now would improve my standard of living. ugh...

Group consensus: Buy now before you're priced out forever!

2nd meeting: A group of senior (lead) engineers, managers, and a senior manager. Half own, half do not.

"The middle class is priced out of the state. Since the company cannot afford raises, when can I transfer to Houston?"

"Foreclosures won't stop. We're going to see the 1990's crash again."

We then discussed a coworker who is selling his place... only to rent it back! Sadly for my coworker, the sale fell through (new info post this meeting). :(

Group consensus: Middle class is priced out of California. Don't worry about it; transfer out of state. My buying status never came into this conversation. The group quickly dismissed anyone who bought today as someone failing an IQ test. Homeowners were working up the guts to sell and rent (some have already). I'm the only bubble blogger in the group (I think...)

The first group would be Subprime or Alt-A buyers.

The second group was all the type who would have 20% down saved up, prime 30-year (or 15 year).

I'm very glad that I won't have to compete with the first group buying a home (soon... die subprime, die!). My purchase will be a happy one (for me). Some failed J6P will turn over their granite countered, 4 bedroom, with a partial view, as soon as this falls out. They'll have to pay to cart away all of their junk to close the deal with me... ;)

The intensity with which the 2nd group wants to move to Houston shocked me. These people love California! Oh... I didn't even have to tell the 2nd group that my company was holding onto land options for Houston. You see... in the 2nd meeting I didn't have much to say anything; I received an education into the 1990 recession (I *thought* that I knew every twist by now...) and previous job relocations from the company. It was also surprising to find someone who knew more about aerospace land options in other states than myself. They also knew about a few bond/currency/leading indicator markets that the housing blogs have been ignoring. Alas, nothing concrete (we did have to get to work...)

The 1st meeting ended with "everyone wants to live in California."

The 2nd meeting ended with a theoretical discussion into the likelihood that the epicenter of US aerospace would shift to Texas or Colorado.

Also of interesting note, a group of non-degreed engineers, who half own and half don't, have become rather vocal about never buying in California (or about to sell). As they put it, if real estate ever becomes really cheap in California, then its time to buy their retirement homes in XX state for tax purposes. (Lively lunch discussion on state taxes...) Some of them bought cheap land around an Idaho lake; they'll retire together as a group. Most are waiting for material prices to drop before initiation construction. (But they are paying for the plans, surveys, and doing contractor research today.)

I also found it very amusing to note that the two groups who are against buying now are the two groups who do not watch much TV. Its also the two groups with good credit and cash in the bank (even if they own a home).

Interesting times ahead...

Got popcorn?

Neil

First meeting: A group of mostly non-degreed support personnel.

It started with a discussion on why I haven't bought a home (everyone else in the meeting owned). After pointing out that the homes I'm looking at should drop $250k in two years... (no disagreement, they were willing to work 'on that theory') The comeback? "You missing out on the appreciation even if it declines."

"Not everyone has your prioritie; some people will buy anyway. Besides, with the weather here, how will prices ever go down?" (Note: every J6P agreed with this; despite the fact we had just talked about record foreclosures!)

I tried to point out that saving $1,200/month+ was enough to lease a new Mercedes every three years and pay all expenses on it... But somehow all of them were convinced buying now would improve my standard of living. ugh...

Group consensus: Buy now before you're priced out forever!

2nd meeting: A group of senior (lead) engineers, managers, and a senior manager. Half own, half do not.

"The middle class is priced out of the state. Since the company cannot afford raises, when can I transfer to Houston?"

"Foreclosures won't stop. We're going to see the 1990's crash again."

We then discussed a coworker who is selling his place... only to rent it back! Sadly for my coworker, the sale fell through (new info post this meeting). :(

Group consensus: Middle class is priced out of California. Don't worry about it; transfer out of state. My buying status never came into this conversation. The group quickly dismissed anyone who bought today as someone failing an IQ test. Homeowners were working up the guts to sell and rent (some have already). I'm the only bubble blogger in the group (I think...)

The first group would be Subprime or Alt-A buyers.

The second group was all the type who would have 20% down saved up, prime 30-year (or 15 year).

I'm very glad that I won't have to compete with the first group buying a home (soon... die subprime, die!). My purchase will be a happy one (for me). Some failed J6P will turn over their granite countered, 4 bedroom, with a partial view, as soon as this falls out. They'll have to pay to cart away all of their junk to close the deal with me... ;)

The intensity with which the 2nd group wants to move to Houston shocked me. These people love California! Oh... I didn't even have to tell the 2nd group that my company was holding onto land options for Houston. You see... in the 2nd meeting I didn't have much to say anything; I received an education into the 1990 recession (I *thought* that I knew every twist by now...) and previous job relocations from the company. It was also surprising to find someone who knew more about aerospace land options in other states than myself. They also knew about a few bond/currency/leading indicator markets that the housing blogs have been ignoring. Alas, nothing concrete (we did have to get to work...)

The 1st meeting ended with "everyone wants to live in California."

The 2nd meeting ended with a theoretical discussion into the likelihood that the epicenter of US aerospace would shift to Texas or Colorado.

Also of interesting note, a group of non-degreed engineers, who half own and half don't, have become rather vocal about never buying in California (or about to sell). As they put it, if real estate ever becomes really cheap in California, then its time to buy their retirement homes in XX state for tax purposes. (Lively lunch discussion on state taxes...) Some of them bought cheap land around an Idaho lake; they'll retire together as a group. Most are waiting for material prices to drop before initiation construction. (But they are paying for the plans, surveys, and doing contractor research today.)

I also found it very amusing to note that the two groups who are against buying now are the two groups who do not watch much TV. Its also the two groups with good credit and cash in the bank (even if they own a home).

Interesting times ahead...

Got popcorn?

Neil

Monday, July 23, 2007

Statistics on San Diego

This is a long reply to this blog by Jim the Realtor. Basically, I do an Anova analysis to see if the 2007 data is different than the other years. The answer? DEFINiTELY. The game has changed.

http://www.bubbleinfo.com/journal/2007/7/23/san-diego-county-sales.html#comments

The graph shows sales in San Deigo over 5 weeks for 2004 through 2007.

Here is the raw data from Jim:

Weekly Closed Sales, San Diego County

2004 2005 2006 2007

June 16-22 545 532 412 337

June 23-29 645 626 461 480

June 30-6 642 605 441 241

July 7-13 505 464 331 252

July 14-20 540 542 423 223

Totals 2877 2769 2068 1533

YOY % chg ------ -4% -25% -26%

What do we see?

What about the weakly sales? That 223 sales is way off... The average of July 14-20 is 432 with a standard deviation of 209. Now what if we took out our week? Average of 501 with a standard deviation of only 68. In other words, 2007 is 4 standard deviations away from the mean.

Chances to be off a standard deviation: Sourcing Wikipedia. :)

http://en.wikipedia.org/wiki/Standard_deviation

Within 1.41 standard deviations is half the data.

Four standard deviations away? 6% chance its random. (Using Chebyshev's inequality values, rather than a normal distribution.) So the July 14-20 week is not a normal variation from other San Diego weeks. Something odd happened.

Ok, how about year to year. For 2003-2006 the average sales per week is: 514.

The standard deviation is 88. For 2007 the average is 306.6. That is 2.34 standard deviations away from the mean. Or... there is about a 17.9% chance that 2007 is just randomly a different year.

Most likely something has changed in 2007 (according to the statistics). Of course, reality says we've driven into the valley and won't pull out for quite a few years.

The change is happening.

Got popcorn?

Neil

People will not listen

While trying to organize a training class that I teach at work the conversation turned to "when will you buy Neil." I noted end of 2009 was the earliest possible.

After discussing:

1. Previous price drops

2. The current foreclosure rates

3. How young people need to leave the state

4. How retirees are leaving the state to cash out

5. California Schools

6. Rents declining...

One guy told me how I should buy as "California home prices won't ever go down. People will all want to live here."

I responded: they don't want to live where they can afford to buy. I also noted that the wait is getting to me and other coworkers. One day I might just decide to move.

The replies were just "California is different." Ugh... Sheeple.

Maybe we are still in denial...

This is going to be a very hard landing.

Got popcorn?

Neil

After discussing:

1. Previous price drops

2. The current foreclosure rates

3. How young people need to leave the state

4. How retirees are leaving the state to cash out

5. California Schools

6. Rents declining...

One guy told me how I should buy as "California home prices won't ever go down. People will all want to live here."

I responded: they don't want to live where they can afford to buy. I also noted that the wait is getting to me and other coworkers. One day I might just decide to move.

The replies were just "California is different." Ugh... Sheeple.

Maybe we are still in denial...

This is going to be a very hard landing.

Got popcorn?

Neil

Tuesday, July 17, 2007

Real Estate Emotions July Update

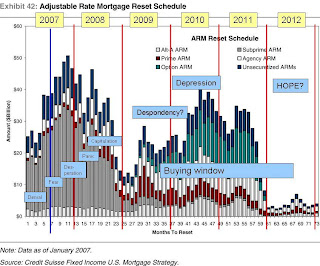

This time I've decided to graph out my real estate emotions on the famous Credit Suisse reset chart. The blue line is what is now in the past.

A review of the investment emotions:

1. Optimism

2. Excitement

3. Thrill

4. Euphoria (market price peak) Peaked in late 2005/early 2006

5. Anxiety (I'm a long term investor, not a speculator.)

6. Denial (Reached in October of 2006 until mid-May of 2007)

****7. Fear (Reached in mid-May of 2007). *****Current state****

8. Desperation Predicted to start in mid-October/November/December 2007

9. Panic: Early 2008 looks to be the start. Exactly when? Depends on the credit markets.

10 Capitulation Could it be summer 2008?

11 Despondency (start of market price bottom)

12 Depression (end of market price bottom) Not before summer 2010

13 Hope (hey, this investment has picked up off its bottom)

14 Relief (Its almost what I paid for it...)

15 Optimism (cycle starts again)

What you should notice is the surplus of housing and rapid reset of ARMs forces fairly quick progress through the initial emotions. However, the integral of the pain will slow steps 10 through 12. In fact, Hope might not happen for quite a few more years than the 2012 timeframe I currently show.

I am making a few assumptions that are new:

1. Mortgage holders continue the recent trend of walking away from losing properties before the ARM reset.

2. By 2011, inflation has taken away much of the sting of the reset.

3. The job losses of late 2007/2008 accelerate the process.

4. The FB's who walk away from their homes can re-enter the market three years post-foreclosure.

5. Home starts in late 2008 drop well below the absorption rate (on a national level).

6. The fraction of FB's who can delay the day of reckoning via refinance is continuously declining.

Points #4 and #6 play quite a bit in my assumptions on when the optimal buying window closes. Notice its a long multi-year window... No rush. None.

Look at the image. Notice something? The pain we've seen so far in 1H 2007 is far less than the pain of mortgage resets in 2H 2007.

I consider anyone who calls a bottom prior to 2009 as someone who has just not looked into the data nor compared this bubble to a previous downturn. The more I look at the data, the further out to the right I correct my predictions for the bottom... So be it.

And if you think that buying window shouldn't start until 2010 or later... let's delay that discussion until 2009, shall we? ;)

The buying window should start after the first wave of prime ARM resets. (In red on the Credit Suisse chart.) I do not believe the Option-ARM resets will occur as graphed (in Green). Too many of those borrowers are doing the minimum payment; thus triggering a reset in 2007/2008/2009. I believe that the driving force of those loans will shift to the left. No proof or links... just logic based on Countrywide et. al reporting that (IIRC) 90% of the option ARM buyers are only making the minimum payment and thus will hit their 110% (or 120%) caps forcing an early reset. :)

The foreclosures of today are going to trigger foreclosures in the winter/2007 spring of 2008. Those foreclosures will pile on the inventory in fall/winter of 2008. It will take until 2009 until people just give up on housing. Only by then will the Sheeple stop listening to the sales people.

But one day it will recover. Its smarter to own long term than to rent. Just not today during such a bubble as we've seen.

Got popcorn?

Neil

Monday, July 16, 2007

I'm boring

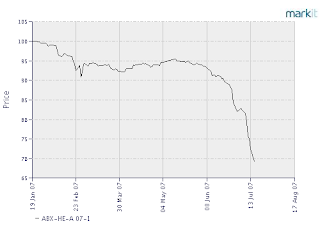

I'm on the same topic again, the state of the mortgage backed security market as represented by the ABX indices. Ok, I missed the stock market prediction last week. Oops.

But look at the A rated ABX index. Please note, a new Y axis versus last week. The close was 69.35 (not updated on the graph headings until the next day). My last post had this at 81.5 cents on the dollar. In round numbers, A rated CMBS bonds dropped 15% in one week. OUCH!

http://www.markit.com/information/affiliations/abx

Every tranch of CMBS is falling fast. AAA rated went from 97.31 to 95.53 today. (OUCH! Those bonds have poor yields due to their "safety.") BBB and BBB- are trading below 50 cents on the dollar. Must suck to have an investment like that hedged. Let's see... 6 times a 50% loss is... Ummm... officer, *that* Mr. Smith is over there (broker bolts for exit).

Anyone who says we haven't seen the darkest days hasn't contemplated what it will be like to get a mortgage come September 1st. Oh... the impact will be less than I imagine... The implode-o-meter will not stay stuck at 99 for very long. ;)

Got popcorn?

Neil

Tuesday, July 10, 2007

Bonds continue to dive

Look at A rated ABX index. At 81.5 cents on the dollar.

I've always heard 82.5 cents on the dollar is the bottom of the normal trading range...

Sound the dive alarm

Got popcorn?

Neil

Update:

The bond market is tanking and this Friday is Friday the 13th.

I'm thinking the stock market is in for a world of pain.

What would a crash of Friday the 13th be called?

Monday, July 09, 2007

Currently There is no Pent up Demand

An Article in the WSJ was just full of good quotes today:

http://tinyurl.com/28tbx8

It concludes with:

"I would argue that this time is different," Morgan's Mr. Stevenson says. "Currently, there is no pent-up demand, the Fed doesn't look like it is cutting interest rates and we haven't gone into economic recession yet."

I'm afraid I just cannot add much to that statement...

But other interesting quotes (Fair use):

With home prices deteriorating, additional book-value erosion for builders appears likely. Mr. Oppenheim estimates that home builders have already written down about 9% of their book values since the peak of the housing boom in July 2005 and are likely to shed an additional 13% of their book values from future land-related charges.

But the timing of such charges can be unclear. Analysts say some builders have been more aggressive in taking write-downs this year, while others may put off some charges -- especially on subdivisions that haven't yet opened, hoping that the market will stabilize.

In other words... builder stocks aren't done yet.

And Wall street knows that the recovery is a long way away.

Got popcorn?

Neil

http://tinyurl.com/28tbx8

It concludes with:

"I would argue that this time is different," Morgan's Mr. Stevenson says. "Currently, there is no pent-up demand, the Fed doesn't look like it is cutting interest rates and we haven't gone into economic recession yet."

I'm afraid I just cannot add much to that statement...

But other interesting quotes (Fair use):

With home prices deteriorating, additional book-value erosion for builders appears likely. Mr. Oppenheim estimates that home builders have already written down about 9% of their book values since the peak of the housing boom in July 2005 and are likely to shed an additional 13% of their book values from future land-related charges.

But the timing of such charges can be unclear. Analysts say some builders have been more aggressive in taking write-downs this year, while others may put off some charges -- especially on subdivisions that haven't yet opened, hoping that the market will stabilize.

In other words... builder stocks aren't done yet.

And Wall street knows that the recovery is a long way away.

Got popcorn?

Neil

Wednesday, July 04, 2007

Apartment Dumpsters

I hope you're enjoying the 4th of July to its fullest. The #1 thing I appreciate about this country is that no matter what socioeconomic level I'm at, I can say anything I want. Eat anything I want, or drink anything I want. :) I do appreciate that that.

We spent the day organizing our place. It made me realize, in 12 to 18 months... someone will downgrade from a house and move into an Apartment. Now, we're renting a decent size townhouse, but will ex-"homeowners" be able to even rent granite countertops? ;) (Hey, if you cook like we do... they're worth it!)

Due to trying to settle into our townhouse, I just haven't had the time to do decent blogging. But one thing I've learned is the value of apartment dumpsters. Some of you had counter-comments when I wondered if all of our stuff would fit into our apartment. (It did.) But we've since been opening up the apartment.

What does this have to do with real estate? Simple, Americans have over consumed for the last few years and are going to have to pay the price for it. Now, my savings rate has been high... so I don't feel to bad.

But when you merge homes you have two choices, have duplicates of everything, or get rid of the surplus (do donate what is of value). But most Americans today... will store it in the garage and buy new (after forgetting they had it). No wonder we have a negative savings rate.

Ok, somethings its worth having duplicates (e.g., cooking tools that fit my wife's hands are like toothpicks in mine. We simply cannot share certain knives, spatulas, etc. But quite a few of my pots and pans made it to the dumpster. Heck one knife I use for "delicate work" she uses as a chef's knife.)

Why do we accumulate so much? Why do we have such a hard time either renting, sharing, or borrowing? I personally think we've lost most of the lessons learned at great cost during the 1930's. Sadly... we're about to relearn many of them.

Most of the townhomes in this complex have half a garage full of "stuff." We've resisted doing that. Actually, we're really only storing moving supplies in our garage (boxes, "peanuts,") and cleaning supplies. Both of our cars fit in the garage.

On a personal note, our living room is now ready for us to go out and buy a new couch. :) Sadly... the "office" doesn't deserve that name yet and we still call it the "box room." We're getting there. I just have to accept that my boxes of books have to be culled...

On a more real estate level...

Just more and more coworkers awakening to the reality that prices will drop.

However... I also know more and more people preparing to move down to the south bay if/when prices drop. Don't expect prices to drop to zero. But they will drop to affordable.

Hopefully you've had such a good 4th that you don't get to this for a few days. ;) Its a day where I celebrate being an American. I really do appreciate what we have.

Despite the sheeple... (Grrr...) But I cannot help but notice there is a mime going through work of being more frugal. Now, I work with engineers, so this mime is probably six months ahead of most places. But I'm still flabbergasted as to how much most of my coworkers are cutting spending. 40% are dramatically cutting spending. 40% are status quo. Only about 20% are accelerating spending. Normally I can tell you what they're accelerating spending on. Now? Its just random today (horses, travel,cars...). But the one oddity... No one is buying airplanes. Normally aerospace engineers are pining to buy an airplane (my company subsidizes flying lessons)... Not one of the people I work with is buying a plane... or boat. So frugality is in.

But then again, the sheeple don't follow the bond market. So they'll be "surprised" pretty soon.

Got popcorn?

Neil

Subscribe to:

Posts (Atom)