Too many of the REIC insist that we'll see the rebound just around the corner. Take a second to look at that graph. My profession involves a heck of a lot of time looking at 'squiggly lines' and figuring out exactly what is happening. So I look at that graph, fair use from WSJ (below) and read it:

http://tinyurl.com/2gfjpt

What I see is linear growth in the subprime late payments. Maybe its going to slightly less than linear, but there is no way that ~16% defaults (going up) will help restart the market. Sorry Mr. bond trader, its going to get worse.

Also take a minute to look at Alt-A. Is it linear on a lesser slope or long term still accelerating? Now, the fact it is less than 4% makes it... not yet of concern. But look closer, it shot up when subprime left its 2nd saddle-point. In other words, they are not independent.

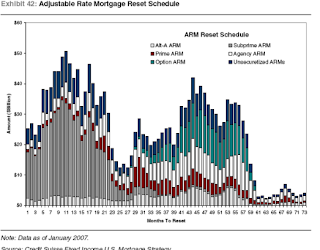

My prediction? We'll find a peak in subprime default rate(if for no other reason than defaulted loans will go through the foreclosure process) in the future. How far? I can see another saddle point, but the peak occurring in 2008. (I've blogged the credit Suisse graph before.) Credit Suisse shows the peak reset rate happening just before the end of 2007... but there is a time lag between reset and delinquency.

With Alt A, the peak reset is in 2010... gulp. That is probably in the trough... Alt-A is just going to be a long grinding pressure down on the market. Subprime is the kick that undermines the market.

If defaults even were to remain constant, the price declines would accelerate. Those graphs show that defaults will continue to rise. Thus I see the pressure on home prices to accelerate. (Oh look, rain is wet!) But this will be one trend I watch to see when prices might be near the bottom. It will lead the bottom in prices by 6 to 18 months. So there just isn't any rush to run in and buy.

Time for me to go jogging.

Got popcorn?

Neil